Investors in stocks on NSE lose N545bn in July

Investors in the nation’s equities market segment of The Nigerian Stock Exchange (NSE) in July, lost N545 billion.

Last month saw the equities market extend losses as investors continued to take profit over deteriorating macro economy challenges which was further accentuated by June 16.5 per cent inflation rate.

Specifically, the market capitalisation which represents total value of stocks listed on the Exchange dropped by N545 billion to close the last trading day of July at N9.620 trillion from N10.165 trillion it opened for the month.

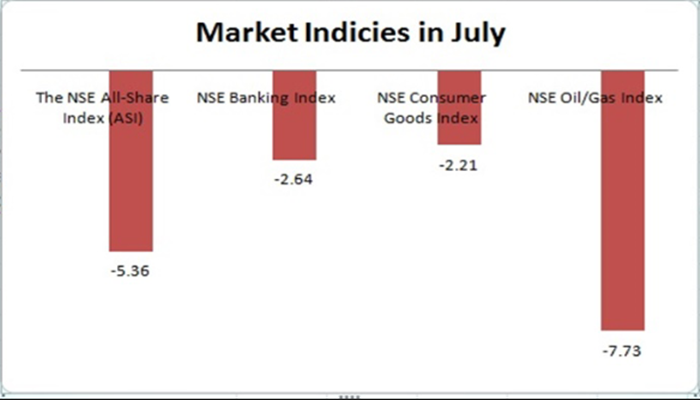

In the same vein, another market indicator, All-Share Index dropped by 5.36 per cent to close at 28,009.93 points from 29,597.79 points it ended on the last trading day in June, 2016, bringing the NSE ASI Year-till-date to 2.21 per cent decline.

Also, the market recorded turnover of N42.874 billion on 4.743 billion shares under the period. Performance across sectors was negative for the month; the Industrial Goods index shed the highest by 13.64 per cent.

Oil and Gas index followed with a decline of 7.73 per cent. Insurance went down by 5.26 per cent, Banking by 2.64 per cent and Consumer Goods index declined by 2.21 per cent.

The best performers for the month were MRS by 11.73 per cent gain, Conoil up by 9.18 per cent and Zenith Bank appreciated by 7.23 per cent. On the other side, Skye Bank depreciated the most by 32.69 per cent, Diamond Bank shed 29.33 per cent and Transcorp dipped by 25.99 per cent to top worst performers.

Analysts said that the month was characterized by the recent foreign exchange reform, unimpressive half year results coupled with profit warnings and late filling announcements, weakening macroeconomic numbers, upward review of the benchmark rate by the Monetary Policy Committee (MPC), among others.

Analysts at Afrinvest Limited noted that investor sentiment continues to be shaped by weakening macroeconomic numbers and expectations of unimpressive half year, 2016 earnings coupled with profit warnings and late filling announcements.

They also said, “We believe the upward review of the benchmark rate by the MPC coupled with the current attractive yields in the money market will dampen interest in equities in the short term as we expect investors may redirect funds to the money market.”

The Managing Director of Highcap Securities Limited, Mr. David Adnori, said, “The current market trend suggests that, optimism that the new Central Bank of Nigeria (CBN) foreign exchange policy would bring relief to the market particularly on banking stocks is beginning to fade as investors remain sceptical about the policy sustainability and transparency.”