Equities gain N80bn in one week

Following an impressive corporate earnings by some blue chip companies for financial year ended December 2016, the equities market gained N80 billion in the first trading week in April.

The market capitalization opened trading in April at N8.829 trillion to close on Friday at N8.909 trillion while All-Share Index also appreciated by 0.90 per cent or 230.18 basis points from 25516.34 basis points market opened for trading this month to close on Friday at 25,746.52 basis points.

However, a turnover of 786.176 million shares worth N5.828 billion in 14,343 deals were traded this week by investors on the floor of the Exchange in contrast to a total of 3.195 billion shares valued at N104.217 billion that exchanged hands last week in 14,674 deals.

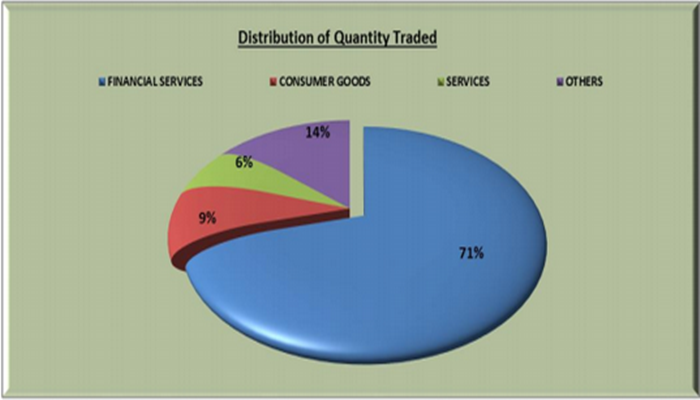

The Financial Services Industry (measured by volume) led the activity chart with 557.911 million shares valued at N2.669 billion traded in 7,340 deals; thus contributing 70.97 per cent and 45.79 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 70.255 million shares worth N1.556 billion in 2,698 deals. The third place was occupied by Services Industry with a turnover of 50.558 million shares worth N70.773 million in 754 deals.

Trading in the Top Three Equities namely – Fidelity Bank Plc, FBN Holdings Plc and Zenith International Bank Plc (measured by volume) accounted for 292.363 million shares worth N1.128 billion in 2,485 deals, contributing 37.18 per cent and 19.35per cent to the total equity turnover volume and value respectively.

Also traded during the week were a total of 1,510 units of Exchange Traded Products (ETPs) valued at N4,113.20 executed in 3 deals compared with a total of 52,885 units valued at N425,464.25 transacted last week in 19 deals.

A total of 11,064 units of Federal Government Bonds valued at N10.256million were traded this week in 21 deals, compared with a total of 2,870 units valued at N2.638million transacted last week in seven deals.