Nigerian bourse up by 7.94% in four-day trading week

The NSE All-Share Index and Market Capitalization of the Nigerian Stock Exchange (NSE) appreciated by 7.94 per cent to close the week at 31,371.63 and N10.845 trillion respectively.

A total turnover of 2.319 billion shares worth N23.813 billion in 22,310 deals were traded this week by investors on the floor of) in contrast to a total of 1.877 billion shares valued at N20.055 billion that exchanged hands last week in 19,979 deals.

It was a four-day trading week as the Federal Government of Nigeria declared Monday 29th May, 2017 as Public Holiday to mark the 2017 Democracy Day celebration.

Similarly, all other Indices finished higher during the week with the exception the NSE Oil/Gas Index that depreciated by 4.54% while the NSE ASeM Index closed flat.

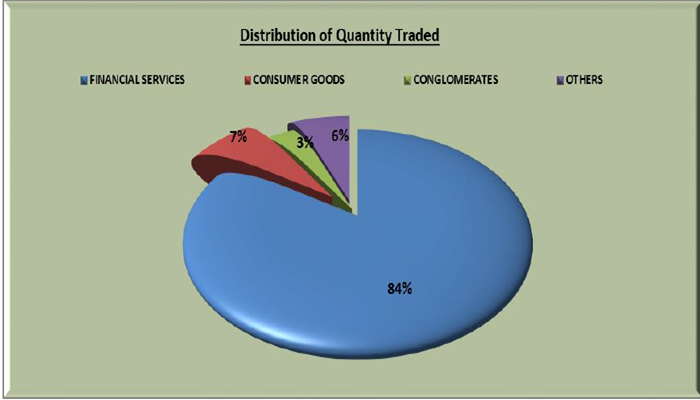

The Financial Services Industry (measured by volume) led the activity chart with 1.950 billion shares valued at N15.479 billion traded in 14,381 deals; thus contributing 84.12% and 65.00% to the total equity turnover volume and value respectively. The Consumer Goods Industry followed with 156.358 million shares worth N2.875 billion in 2,804 deals. The third place was occupied by Conglomerates Industry with a turnover of 70.452 million shares worth N168.377 million in 739 deals.

Trading in the Top Three Equities namely – Diamond Bank Plc, FBN Holding Plc and United Bank for Africa Plc (measured by volume) accounted for 978.710 million shares worth N4.137 billion in 5,028 deals, contributing 42.21% and 17.37% to the total equity turnover volume and value respectively.

Also traded during the week were a total of 52 units of Exchange Traded Products (ETPs) valued at N13,802.70 executed in 6 deals compared with a total of 65 units valued at N1,967.85 transacted last week in 7 deals.

A total of 3,786 units of Federal Government Bonds valued at N3.806 million were traded this week in 4 deals, compared with a total of 50 units valued at N43,719.69 transacted last week in 1 deals.

Six-one (61) equities appreciated in price during the week, higher than forty-four (44) equities of the previous week. Twelve (12) equities depreciated in price, lower than twenty-five (25) equities of the previous week, while one hundred (100) equities remained unchanged lower than one hundred and four (104) equities recorded in the preceding week.