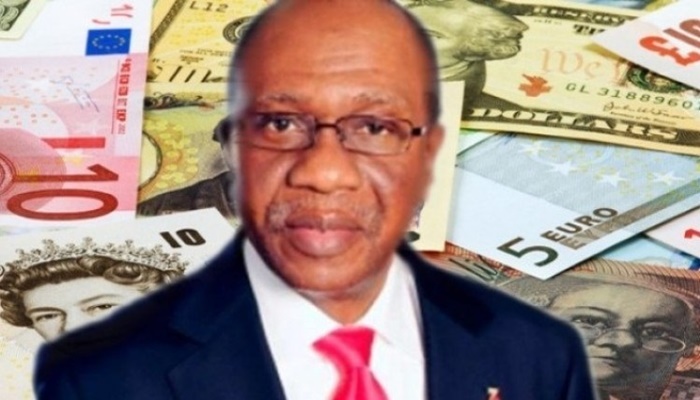

Emefiele highlights benefits of movable assets, Credit Reporting Acts

Central Bank of Nigeria (CBN) Governor, Mr. Godwin Ifeanyi Emefiele at the weekend expressed satisfaction with the Secured Transactions in Movable Assets Act (otherwise known as National Collateral Registry Act) and the Credit Reporting Act, that were recently signed into law by acting President Yemi Osinbajo, saying they would help to expand access to financing by Micro, Small and Medium Scale Enterprises (MSMEs) in the country.

This is one of the cardinal objectives of the development finance function of the CBN, he said.

Emefiele, who said this in an exclusive interview with THISDAY in Lagos, also reacted to criticism of the central bank’s creation of several foreign exchange (FX) windows, saying the policy was targeted at helping to correct the crisis in the market.

In addition, Emefiele reiterated that Nigerian banks were safe and sound despite the foreign currency scarcity and external shocks that they have had to contend with in recent months, leading to the rise in non-performing loans (NPLs) above the regulatory threshold and impaired capital adequacy ratios (CAR).

On the benefits of the National Collateral Registry, Emefiele said when he resumed as governor on June 3, 2014, one of his vision statements was to ensure improved access to credit to MSMEs.

As part of efforts to achieve this, he disclosed that since 2014, the CBN has been working with the International Finance Corporation (IFC), an arm of the World Bank, to sponsor the bill on the Collateral Registry.

“I am delighted that, that bill has been passed into law and has also been assented to by the acting president. What that does is that it provides a legal framework under which banks can lend money to the SMEs.

“Banks would naturally not lend without taking collateral because of the perceived risk of either non-performance arising from business failure.

“So, because the banks are in business not to lend their own money, but depositors’ money, they would want to be sure that whatever money that they lend to any person or corporate entity, is secured.

“But some SMEs don’t have fixed assets like buildings or land that banks can hold on to as collateral in the event of business failure. So the idea of movable collateral makes it easy to say, if you have a car, you can register it through the registry and the bank would take the car as collateral and register it in the registry.

“The registry would assign certain code numbers, which gives that bank exclusive charge over that car, so that in case there is failure, they can possess the car and with the legal framework in place, they would be able to sell the car to realise what they lent out as loan.

“Similarly, if you are a hairdresser, the bank can take the hairdressing equipment, if you are a mechanic, they can take your mechanical tools, or any kind of business.”

To this end, Emefiele expressed optimism that with this law, Nigerian lenders would be further encouraged to loan to the SMEs, saying that the CBN in collaboration with the banks would soon start creating awareness on the benefits of the National Collateral Registry.

“Of course, this will not go without some form of awareness. So the next round of engagement that would take place is that the central bank and the banks would start some form of engagement and campaigns for the SMEs to access loans through the framework created by the collateral registry.

“I believe once that is done, we would see the sustainable and inclusive growth that we are looking for. In Nigeria, we have close to 40 million SMEs. So, for us to be able to provide jobs for people, we need to encourage the SMEs to be able to access finance.

“So I think with the kind of campaign that the CBN would begin to engage in, it would help to spur lending to SMEs.

“The other bill that was signed into law is that of credit bureaus. It will also help to increase our credit discipline. There are people who are perpetual debtors in the sense that they take loans and they don’t want to repay. They move from one bank to another, deceiving bankers and collecting loans.

“So, what the Credit Reporting Act does is to ensure that banks are able to see their customers’ credit history.

“If it is good, the bank would be encouraged to lend and if it is bad, the bank would encourage the customer to go and clear his bad credit history before they can lend, or they would just refuse to lend to the customer,” he explained.

On the multiplicity of FX windows in the market, the CBN governor said they were created to ensure that Nigerians that have legitimate demand for FX were not excluded from the market.

The CBN has different FX windows for various segments of the economy, comprising one for SMEs, another one for investors and exporters, and yet another one for retail invisibles such as PTA, BTA, school and medical fees, which have continued to attract criticism.

“First, I think it is important to understand the reason behind creating those windows. You find out that when the CBN, in this case under the wholesale Secondary Market Intervention Sales (SMIS) for instance, allocates $10 million to a bank, that bank’s preference would be to allocate the FX to its large customers.

“That was what we observed. And we began to say, what happens to the vulnerable, the SMEs, those who want to pay school fees and those who want to travel? So that was what necessitated the creation of those windows,” he said.

The CBN governor also defended the criticism that there are multiple exchange rates in the market, saying that the prevailing rate was N360 to the dollar.

According to him, recent FX measures by the CBN were initiated to ensure that various sectors or sub-sectors of the economy were able to access FX for their business.

He expressed satisfaction with the fact that Nigerians who need to travel can now access FX for PTA or BTA and school fees, while SMEs can also access $20,000 per quarter for their inputs.

He added: “Our happiness is that these people are able to access the FX market rather than go to the alternative market, which is the parallel market.

“This is because when they go to the parallel market, they shoot up the demand in the parallel market, which is what primarily contributed to the high exchange rate in that market.

“Now, what we have done is to move them from that market into the official market at an exchange rate that is better than the rate they would have sourced if they went to the alternative market. So, I would say things are working well.

“We set up the investors and exporters’ window and what that did was that it eliminated some of the sharp practices that we saw in the market. Now, everything is done in the open and in a very transparent manner.

“If you want to sell your dollars, you offer the banks and the bank knowing that he has a buyer, matches you with the buyer and the bank makes only N1 spread. With the transparency that has been brought into that market, we have seen a lot of inflows into that market and rates began to converge.”

Emefiele, who also disclosed that the central bank was still conducting stress tests on Nigerian lenders, allayed concerns over the health of the banks, pointing out that Nigerian banks were among the most regulated financial institutions globally.

He explained: “First it is important that we all know that there is no need to grandstand about stress-testing. The CBN under its current management does stress-tests under different scenarios using the balance sheets, non-performing loans (NPLs) and other performance indicators of the banks on a regular basis and based on that we are able to determine what advice to give and what action the bank can take.

“So stress-testing is like a normal thing in the CBN today. It is not something we want to grandstand about because the process of grandstanding may create unnecessary noise that might create problems for the banking system.

“But aside from that, it is important for us to know that in the entire world, when there are global shocks, external shocks, beyond the control of anybody, there would be incidents of NPLs rising and you can go and check data in any jurisdiction to ascertain that.

“But I think what is important is how well the banking sector is prepared to absorb those shocks. The Nigerian banking industry I always say is one of the most regulated in the world today.”

According to Emefiele, the standard practice in several jurisdictions is that the Capital Adequacy Ratio (CAR) requirement for banks should be eight per cent, minimum.

But in Nigeria, the smallest bank is expected to maintain a CAR of 10 per cent, while the large Systemically Important Banks (SIBs) are expected to maintain 15 per cent as CAR.

“What we have done with this is to provide capital buffers for the banks to be able to withstand shocks. But of course there are internal guidance limits, when these rates go above your own internal guidance limits, people tend to make noise and say the institutions are weak.

“I think the important thing to remember is that a lot of shock absorbers have been built into the system to ensure that the banks are either relatively well capitalised or have proper levels of liquidity to be able to run their businesses so that depositors’ funds are not in jeopardy.

“We are also working hard to ensure that some of the weak ratios are addressed in some of the banks. But for me, there is no cause for worry, there is no cause for concern and we would continue to work assiduously to see to it that we are able to manage the banks so that depositors’ funds are safe. That is our primary mandate and that is why we are doing what we are doing,” he said.

He revealed that banks had started complying with an agreement reached at the 2016 Bankers’ Committee retreat requiring them to contribute five per cent of their profit after tax into the Agriculture and Small and Medium Enterprises Equity Fund.

“To date, we have close to N26 billion in that account sitting in the CBN. We have started engagements and we have told the banks and we at the CBN have also started our engagement with certain institutions,” he disclosed.

Credit: Thisday.