Nigeria bourse ends five-day rally on MSCI moves, etisalat fears

Nigerian stocks fell 2.4 percent on Wednesday after index provider MSCI said it would leave the country in its frontier index until at least November, when it will again assess investor access to the market.

It said Nigeria would remain a frontier market, with the possibility of being downgraded to “standalone” status,

The index of Nigeria’s top 10 banks its relatively liquid sector, shed 2.6 percent partly on the MSCI news, and after Etisalat Nigeria failed to agree a debt renegotiation deal with lenders.

The market capitalisation shed N311 billion or 2.62 per cent to close at N11.576 trillion compared with N11.887 trillion recorded on Tuesday. Also, the All-Share Index lost 897.71 points to close at 33,477.89 against 34,375.60 achieved on Tuesday.

Major blue-chip stocks recorded price depreciation with Nestle leading the losers’ chart with a loss of N10 to close at N900 per share. Dangote Cement trailed with a loss of N8.97 to close at N205 and 7UP shed N2.99 to close at N90.01 per share. Lafarge Africa was down by N2.20 to close at N52 and Nigeria Breweries depreciated by N2 to close at N166 per share. On the other hand, Conoil that led the gainers’ table, growing by N1.92 to close at N40.42 due to investors reaction to the N3.10 dividend proposed for 2016 financial year. CAP followed with a gain of 79k to close at N34.99 while Cement Company of Northern Nigeria appreciated by 53k to close at N11.27 per share. UACN added 35k to close at N17.90 and NASCON increased by 20k to close at N10 per share.

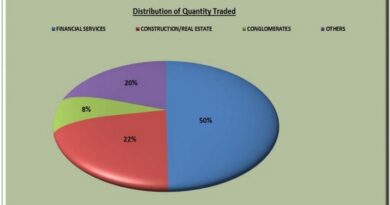

In spite of the drop in market indices, the volume of shares traded closed higher with an exchange of 508.73 million shares worth N6.39 billion transacted in 5,876 deals. This was in contrast with a turnover of 392.27 million shares valued at N4.23 billion transacted in 5,412 deals on Tuesday.

Zenith Bank drove the activity chart, trading 87.93 million shares worth N1.86 billion. Fidelity Bank followed with an account of 53.32 million shares valued at N71.48 million and Guaranty Trust Bank traded 50.28 million shares worth N1.79 billion. Diamond Bank exchanged 45.63 million shares valued at N55.67 million, while United Bank for Africa sold 40.45 million shares worth N336.85 million.

Picture caption:

L – R: Haruna Jalo-Waziri, Executive Director, Capital Markets Division, The Nigerian Stock Exchange (NSE); Oladele Afolabi, Director, Portfolio Management Department, Debt Management Office (DMO); Oscar N. Onyema OON, Chief Executive Officer, NSE; Dr. Abraham Nwankwo, Director General, DMO; Joe Ugoala, Director, Policy, Strategy & Risk Management Department, DMO, Ade Bajomo, Executive Director, Market Operations and Technology, NSE and Acting Head, Corporate Services Division, NSE at the Closing Gong Ceremony at the Exchange on Wednesday.