NSE reviews composition of market indices

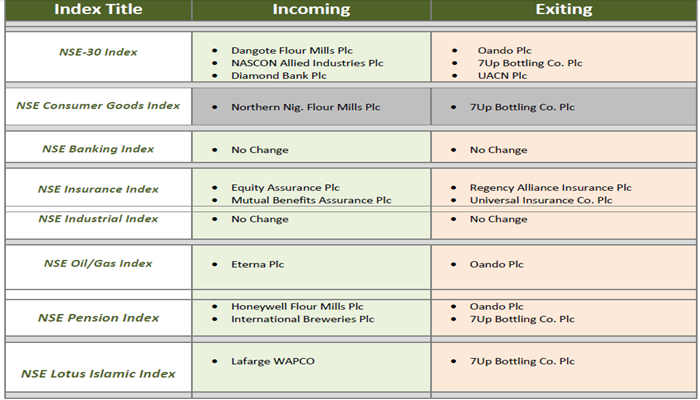

The Nigerian Stock Exchange (NSE) has reviewed the NSE-30, and the seven sectoral indices of the Exchange, which are NSE Consumer Goods, NSE Banking, NSE Insurance, NSE Industrial, NSE Oil & Gas, NSE Pension and the NSE Lotus Islamic Indices.

According a press statement from the Exchange, the composition of the indices is effective January 1, 2018 after the completion of the year-end review and index rebalancing exercise which will see the entry of some major companies and the exit of others from the various indices.

“The indices, which were developed using the market capitalization methodology, are rebalanced on a biannual basis -on the first business day in January and in July.

“The stocks are selected based on market capitalization and liquidity. The liquidity is based on the number of days the stock is traded during the preceding two quarters. To be included in the index, the stock must have traded for at least 70 percent of the number of trading days in the preceding two quarters.

“The Nigerian bourse began publishing the NSE 30 Index in February 2009 with index values available from January 1, 2007. On July 1, 2008, The NSE developed four sectoral indices and one index in 2013, with a base value of 1,000 points, designed to provide investable benchmarks to capture the performance of specific sectors.

“The Insurance and Consumer Goods sector index, is comprised of the 15 most capitalized and liquid companies; Banking and Industrial Goods sector index, comprised of 10 most capitalized and liquid companies, while the Oil & Gas sector index, is comprised the seven most capitalized and liquid companies.

“The compiler of the indices maintains the right to modify the circulated selection above in connection with any mergers, takeovers, suspension or resumption of trading or any other company structure changes during the period before the effective date of the annual review”.