Nigerian bourse sheds N187bn Wednesday as profit taking persists

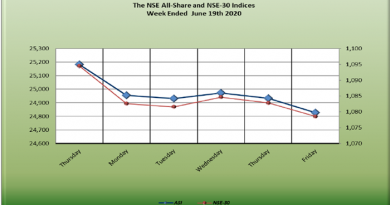

Trading on the Nigerian Stock Exchange on Wednesday went down by N187 billion as a result of profit taking by investors on the Exchange. That makes it a third straight downward movement on the Exchange.

At the close of the day trading, the NSE market capitalisation dropped to N15.902 trillion from N16.089 trillion while the All-Share Index dropped by 702.98 basis points.

A total of 43 stocks depreciated in price at the end of transactions. The losers were dominated by the banking stocks with the sector accounting for 15 of the losers at the end of the day’s trading. FCMB Group, led the pack, depreciating b y 9.71 percent to close at N3.07 from N3.40.

The shares of another tier 2 bank, Diamond Bank Plc, depreciated by 9.60 percent to close at N2.92 from N3.23 per share. Fidelity Bank Plc ranked third in losers chart, dropping by 9.52 percent to close at N3.23 from N3.57, while Sterling Bank Plc and Transcorp Plc went down by 9.35 percent each to close at N1.94 and N1.94 from N2.14 and N2.14 per share respectively.

Conversely, 11 stocks led by May & Baker Plc appreciated in price. May & Baker’s shares rose by 4.95 percent to close at N2.97 from N2.83, followed by Transnationwide Express Plc, which appreciated by four percent to close at N0.78 from N0.75.

Wapic Insurance Plc ranked third, rising by 3.64 percent to close at N0.57 from N0.55. Cement Company of Northern Nigeria, CCNN, went up by 3.47 percent to close at N17.90 from N17.30, while Learn Africa Plc chalked up by 2.13 percent to close at N0.96 from N0.94 per share.

Commenting on the market, analysts at FSDH said: “There was sell pressure in the equity market, a combination of profit taking and price corrections predominantly in the banking sector stocks. The downward trend may likely continue till midweek.”