Nigerian bourse down 2.93% for the week

The All-Share Index and Market Capitalization of the Nigerian Stock Exchange (NSE) depreciated by 2.93 per cent and 2.87 per cent to close the week at 43,773.76 and N15.692 trillion respectively.

Similarly, all other indices finished lower during the week with the exception of the NSE Consumer Goods and NSE Oil/Gas Indices that appreciated by 2.15% and 0.08% respectively while the NSE ASeM Index closed flat.

Thirty (30) equities appreciated in price during the week, lower than forty (40) of the previous week. Forty-four (44) equities depreciated in price, higher than thirty-two (32) equities of the previous week, while ninety-eight (98) equities remained unchanged lower than one hundred (100) equities recorded in the preceding week.

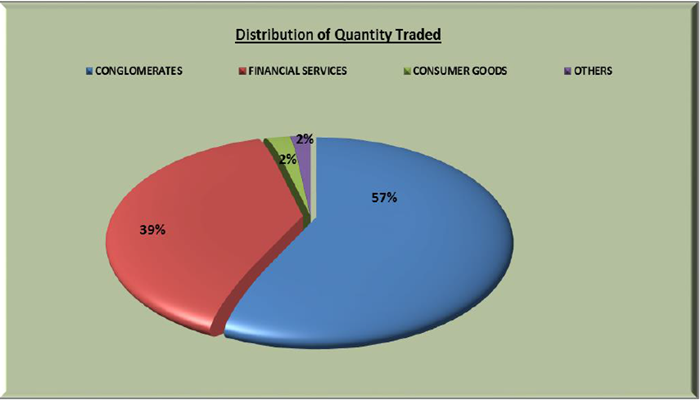

The Conglomerates Industry (measured by volume) led the activity chart with 4.110 billion shares valued at N10,016 billion traded in 2,454 deals; thus contributing 57.43% and 23.54% to the total equity turnover volume and value respectively.

The Financial Services Industry followed with 2.757 billion shares worth N25.398 billion in 25,853 deals. The third place was occupied by Consumer Goods Industry with a turnover of 156.224 million shares worth N5.304 billion in 5,875 deals.

Trading in the- top three equities namely – Transnational Corporation of Nigeria Plc, FCMB Group Plc and Skye Bank Plc (measured by volume) accounted for 4.786 billion shares worth N11.341 billion in 5,216 deals, contributing 66.86% and 26.66% to the total equity turnover volume and value respectively.

Also traded during the week were a total of 153,755 units of Exchange Traded Products (ETPs) valued at N1.883 million executed in 11 deals, compared with a total of 1.947 million units valued at N105.567 million that was transacted last week in 15 deals.

A total of 6,715 units of Federal Government Bonds valued at N5.318 million were traded this week in 15 deals, compared with a total of 4,437 units valued at N4.260 million transacted last week in 9 deals.

Also, an additional volume of 67,801,163 ordinary shares of Nigerian Breweries Plc (“NB”) were listed on The Daily Official List of The Exchange on the 24th of January, 2018. These additional shares were as a result of the Scrip Dividend Scheme offered to eligible shareholders of Nigerian Breweries Plc, who elected to receive new ordinary shares in lieu of cash dividends with respect to the 258 kobo final dividend declared for the year ended 31 December 2017. With this listing, the company’s total issued and fully paid up shares now stands at 7,996,902,051 ordinary shares.

An additional volume of 39,374,090 units and 134,648,698 units were added to 14.50% FGN JUL 2021 and 16.2884% FGN MAR 2027 respectively on the 25th of January 2018.