Capital market indices maintain downward trend

Crucial indicators of the performance of the Nigerian Stock Exchange (NSE) dipped further on Wednesday, recording a marginal loss of 0.06 per cent.

The News Agency of Nigeria (NAN) reports that the slide is due to losses posted by highly capitalised and medium-size equities.

Okomu Oil Palm topped the laggards’ table, dropping by N1.70 to close at N92.50 per share.

ement Company of Northern Nigeria trailed with a loss of N1.20 to close at N23.50, while Seplat was down by N1 to close at N650 per share.

Mobil Oil shed N1 to close at N181, while Cadbury lost 50k to close at N12.50 per share.

Consequently, the market capitalisation dropped N9 billion to close at N13.752 trillion against N13.761 trillion on Tuesday.

In the same vein, the All-Share Index which opened at 37,988.54 points lost 26.41 points or 0.06 per cent to close at 37,963.93.

Conversely, Total led the gainers’ table, appreciating by N7.20 to close at N200.50 per share.

Stanbic IBTC followed with a gain of N1 to close at N50, while Lafarge Africa increased by 95k to close at N40 per share.

Union Bank of Nigeria added 25k to close at N6.15, while Africa Prudential Registrar advanced by 15k to close at N4 per share.

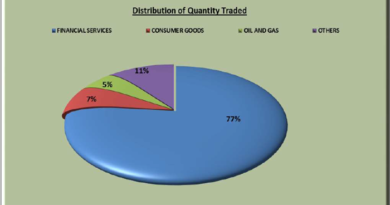

Also, the volume of shares transacted closed lower with an exchange of 372.24 million shares valued at N3.18 billion achieved in 3,800 deals.

This was in contrast with a total of 539.67 million worth N4.71 billion traded in 4,202 deals on Tuesday.

Sterling Bank was the toast of investors, accounting for 172.63 million shares valued at N241.03 million.

Zenith International Bank followed with 31.54 million shares worth N792.74 million, while Transcorp sold 22.92 million shares valued at N31.98 million.

United Capital exchanged 21.18 million shares worth N69.34 million, while United Bank for Africa sold 16.62 million shares valued at N175.79 million.

Credit: NAN.