Diamond Bank confirms acquisition by Access Bank

It is not more in the realm of conjecture as Diamond Bank Plc confirmed its decision to merge with Access Bank Plc, in a bid to become the biggest retail bank in Africa.

“The Board of Diamond Bank Plc (“Diamond Bank”) announces that following a strategic review leading to a competitive process, the Board has selected Access Bank Plc (“Access Bank”) as the preferred bidder with respect to a potential merger of the two banks (“the merger”) that will create Nigeria and Africa’s largest retail bank by customers,” the bank’s head of Corporate communications, Chioma Afe said in a statement on Monday.

“The Board of Diamond Bank believes that the merger is in the best interest of all stakeholders including, employees, customers, depositors and shareholders and has agreed to recommend the offer to Diamond Bank’s shareholders, ” he added.

The announcement came more than a month after Access Bank denied having an agreement to take over assets of Diamond Bank Nigeria or any other institution in Nigeria.

However, Diamond Bank confirmed that the merger would involve Access Bank acquiring its entire issued share capital in exchange for a combination of cash and shares in Access Bank via a Scheme of Merger

Afe maintained that “based on the agreement reached by the Boards of the two financial institutions, Diamond Bank shareholders will receive a consideration of N3.13 per share, comprising of N1.00 per share in cash and the allotment of 2 New Access Bank ordinary shares for every 7 Diamond Bank ordinary shares held as at the Implementation Date.”

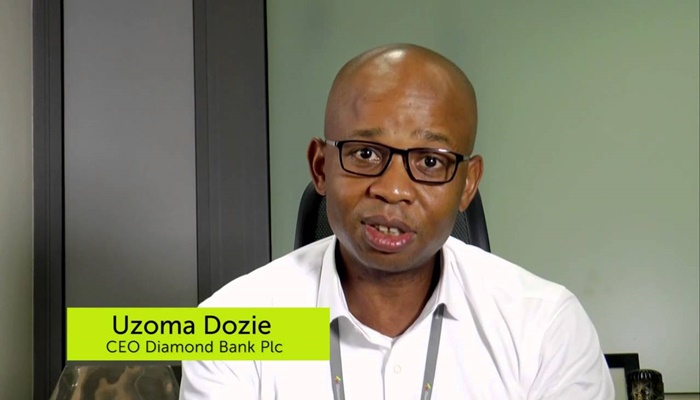

Also, the bank’s CEO, Uzoma Dozie, affirmed that “the proposed combination with Access Bank will create one of Africa’s leading financial institutions”.

“There is a clear strategic rationale for the proposed merger and strong complementarities between the two institutions,” he added.

However, the completion of the merger is subject to certain shareholder, regulatory approvals and the current listing of Diamond Bank’s shares on the NSE with the listing of the Bank’s global depositary receipts on the London Stock Exchange will be cancelled, when the merger becomes effective.