…Naira hits N400/$

Perhaps as a fall out of the ban from foreign exchange market by the Central Bank of Nigeria (CBN), the share price of most of the affected lenders received some bashing on the Nigerian Stock Exchange (NSE) yesterday. Diamond Bank Plc, First City Monument Bank Plc, Sterling Bank Plc, among others tumbled on yesterday as investors sell-off.

Others listed banks on the Nigerian Stock Exchange (NSE) banned by CBN include United Bank for Africa Plc, Skye Bank Plc, Fidelity Bank, First Bank of Nigeria Holdings Plc. The other two banks, Heritage Bank and Keystone are not listed banks on the trading floor of the Exchange.

The CBN on Tuesday bared nine banks from participating in the foreign exchange market for failing to return a total of $2 billion of Nigerian National Petroleum Corporation (NNPC)/Nigerian Liquefied Natural Gas (NLNG) Company dollar deposits to the federal government’s Treasury Single Account (TSA) domiciled with the CBN. However, UBA has been reported to have sorted out itself.

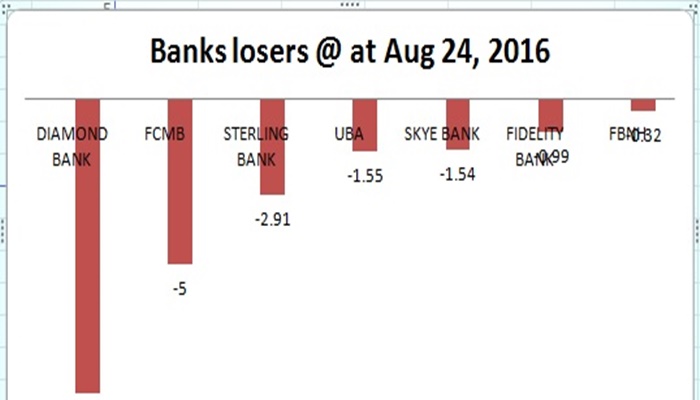

According to data gathered by Business247 News Online, Diamond Bank Plc recorded the highest drop in its share price, as investors’ loss 8.94 per cent or 0.11 from the N1.23 opening value on Wednesday to close at N1.12.

FCMB came second after dropping five per cent or N0.06 from N 1.20 to N1.14 while Sterling Bank share price lost 2.91 per cent or N0.03 from N 1.03 to N1.00.

Others are UBA and Skye Bank Plc that depreciated by 1.55 per cent and 1.54 per cent to N 4.46 and N0.64 from N4.53 and N0.65 the equities market opened on Wednesday respectively.

Furthermore, share price of Fidelity Bank Plc dropped by 0.99 per cent or N0.01 from N1.01 to N1.00 while First Bank of Nigeria Holdings share price decreased by 0.32 per cent or N0.01 to N3.17 from N3.16.

In a related matter, the naira at the parallel market crossed the N400/per dollar mark on Wednesday to N402/per dollar.

The naira, which traded around 396/$1 on Tuesday, depreciated rapidly on Wednesday after the news of the nine banks banned by CBN from FX.

The interbank market closed at N305 to the dollar on Tuesday, but is currently trading at N335 at the interbank market.

A bureau de change (BDC) operator, who spoke to our correspondent, said the market was reacting to the news.

According to him, “We are now buying dollars at N400, and selling at N402. Pounds is selling at N520 today, from about N507 yesterday.”

In addition to suspending them from the FX market, the affected banks, according to industry sources, still face the prospect of further financial fines, which shall be communicated to them by the CBN in the coming days, our correspondent gathered.

The affected banks, whose suspension would remain in force until they remit all the funds to the TSA, are the UBA Plc – $530 million, First Bank of Nigeria (FBN) Ltd. – $469 million, Diamond Bank Plc – $287 million, Sterling Bank Plc – $269 million, Skye Bank Plc -$221 million, Fidelity Bank Plc – $209 million, Keystone Bank Ltd. – $139 million, FCMB Ltd. – $125 million, and Heritage Bank Limited – $85.5 million.

Comments are closed.