Zenith Bank, FBN Holdings sustain stronger liquidity –Investigation

Zenith Bank Plc and First Bank of Nigeria (FBN) Holdings Plc have stronger liquidity ratio required by Central Bank of Nigeria (CBN) to absorb a reasonable shock from customers’ emergency withdrawal.

Liquidity ratios are a class of financial metrics used to determine a bank’s ability to pay off its short-term debts obligations. The higher the value of the ratio, the larger the margin of safety a bank possesses to cover short-term debts.

According to CBN, commercial banks will need to maintain minimum liquidity ratio of 30 per cent in line with regulatory requirement.

The apex bank had introduced stringent measures on liquidity ratio so as to strengthen Depositor Money Banks (DMBs) operating in the country.

Business247 News Online can report that the above mentioned DMBs maintained stronger liquid assets than any other banks in Nigeria.

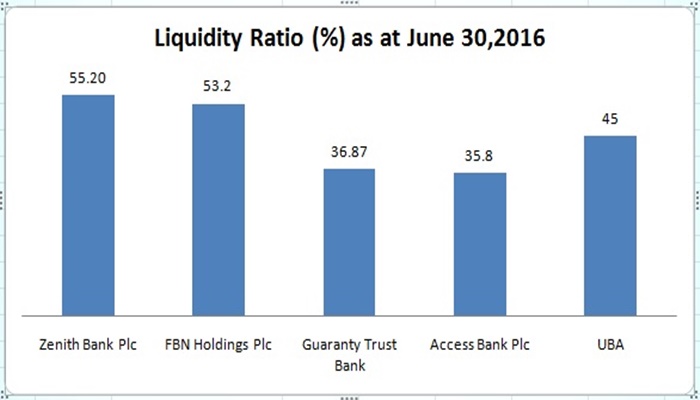

For instance, Zenith Bank Plc has the highest liquidity ratio as at half year ended June 30, 2016, followed by First Bank of Nigeria Holdings Plc.

Zenith Bank’s liquidity ratio for the period under review was at 55.2 per cent while that of First Bank of Nigeria Holdings for the period under review was at 53.2 per cent.

Further investigations revealed that United Bank for Africa (UBA) has 45 per cent; Guaranty Trust Bank, 36.87 per cent and Access Bank Plc, 35.8 per cent.

CBN, however, said merchant and non-interest banks shall continue to maintain a minimum Liquidity Ratio (LR) of 20 and 10 per cent, respectively, subject to review from time to time.

CBN in its Monetary, Credit, Foreign Trade and Exchange Policy for fiscal years 2016/2017 guidelines, said discount houses shall continue to invest at least 60 per cent of their total liabilities in government securities in the 2016/2017 fiscal period, while the ratio of individual bank loans to deposits, is retained at 80 per cent.

It said the major tool for liquidity management will continue to be Open Market Operation (OMO) Auctions, conducted through the sale and purchase of Treasury Bills and CBN Bills at the two-way quote trading platform.

Athekame Kenneth liked this on Facebook.

LIke your site. Do you want to trade links.