Nigeria in recession: the devaluation came day late, a dollar short

Efforts to steer away from oil may allow the country to avoid future commodity shocks, writes Julians Amboko

In January 2016, I tabled a prognosis for Nigeria anchored on the premise of an economy set to tread a tight rope between soaring inflation and deceleration of its growth momentum. Seven months later, inflation had inched to a high of 17.1 per cent and the economy had decelerated at a more torrid pace than I had anticipated, slumping into recession following 0.4 per cent and 2.1 per cent contractions in the first and second quarters of 2016, respectively. The reason for divergence between expectation and outcome in the latter is that, generally, economic data is very noisy, often times triggering overstatement of risks in some cases while blurring perspective on how far-reaching others could be. As it would turn out, if there were hopes the economy would take a hard landing on its feet, it seems to have done so on its belly and it is important that sub-Saharan Africa unpacks the build-up to this position.

Devaluation of the naira: A day late, a dollar short

An invaluable take home from Nigeria’s experience is that there was nothing inevitable about the economy slumping into recession and in crisis fire fighting, and it pays to exercise prudent triage and know which problems to solve first. For reasons best known to the Central Bank, devaluation of the naira was a subject over which the country dithered longer than was necessary.

In defence of the Central Bank, however, the issue was less straightforward than widely-held opinion suggested: the economy was grappling with rising double digit inflation by the end of the first quarter of 2016 (12.8 per cent as of March 2016) and the prospect of devaluation risked piling more cost-push (inflation occasioned by a rise in the cost of imports) pressure on the same. But Nigeria was already in the throes of bigger problems with declining oil production (falling from 2.1 to 1.5 million barrels per day between August 2015 and June 2016, according to Nigeria’s National Petroleum Corporation) making a bad situation even worse.

Whereas opinion remains divided as to when the naira ought to have been devalued, the 23 June 2015 Central Bank directive listing items not valid for foreign exchange was, arguably, the canary in the coal mine bespeaking an economy stretched thin for solutions out of a deepening predicament. To be clear, currency devaluation is not a tool of day-to-day monetary policy. In fact, the Articles of Agreement of the International Monetary Fund and the International Bank for Reconstruction and Development provide that a member shall not devalue its currency except in the interest of correcting fundamental disequilibrium.

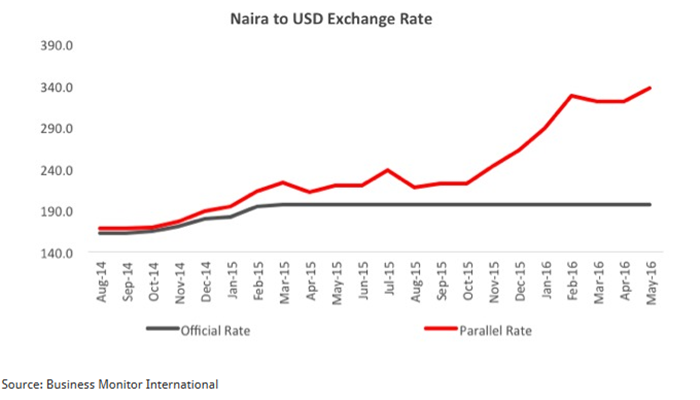

By end of the first quarter 2016, it was clear that Nigeria’s trade position was shifting to the negative, having registered a trade deficit of US$ 594 million compared to a surplus of US$ 5.8 billion in the first quarter of 2013 [National Bureau of Statistics data on merchandise trade (US$ 1.0 = Naira 309.9)]. Disequilibrium in the economy, however, did not manifest more clearly anywhere else than it did in the widening rift between the official (pegged) and parallel exchange rates as the market suffered in the stranglehold of a dollar crunch, on the back of depressed foreign exchange earnings. The Manufacturing Association signallled the red flag that businesses faced imminent closure owing to inability to service greenback-denominated import obligations. That was a clear indication that relaxation of foreign exchange controls was the painful laden medication the patient so much needed but whose dispensation the physician continued to pussyfoot around (until 20 June 2016, just about a month after the national bureau of statistics revealed that the economy had slogged through contraction in the first quarter.)

What Next for Nigeria?

Nigeria’s monetary policy response to the after-effects of the plunge in oil prices has had two broad impacts: not only has it helped bring the country to a screeching recession but also sapped investor confidence in the government’s ability to steer the economy through the headwinds of a volatile global environment. The confidence that President Buhari’s reform agenda had won over at the infancy of its administration has been undermined as many begin to appreciate that doing things right and doing the right things can, at times, be poles apart.

In 2015, for the first time in over two decades, Ghana attracted more Foreign Direct Investment (FDI) than Nigeria, US$ 3,192.3 million and US$ 3,064.2, respectively. To put this into perspective, it is important to appreciate that Ghana’s economy is undergoing an equally, if not more, tumultuous phase with public debt at a staggering 73.3 per cent of GDP (against Nigeria’s 11.5 per cent); inflation at 16.7 per cent (July 2016) and an energy crisis. Electricity generated declined by 4.4 per cent between 2012 and 2015 to 11,492.0 Gigawatt Hours[1], which has undermined the investment climate.

This has become a sobering awakening to the fact that the leadership position of West Africa’s sweet spot is not the preserve of Nigeria. Whereas in 1990 Nigeria accounted for 64.5 per cent of the region’s FDI, this proportion would be scaled down to 50.8 per cent by 2010 and 31.0 per cent by 2015 (UNCTAD, 2016), a trend bespeaking declining dominance.

Inflation fears notwithstanding, the Central Bank of Nigeria is bound to go slow on its monetary tightening gear in the coming quarters in an effort to catalyse private sector activity to restore growth. Month-on-month private sector credit growth averaged 2.7 per cent in the first half of 2016 compared to 0.4 per cent and 1.2 per cent in the same period in 2015 and 2014 (Central Bank of Nigeria data), respectively, boding well for an investment climate in need of stimulus. It also suggests that Nigeria, having been in a broadly tightened monetary policy environment between 2011 and 2015, was found ill prepared for the shock of a precipitous plunge in global oil prices.

The Diamond in the Rubble: Why Nigeria cannot be written of

The present economic malaise notwithstanding, investors should not hasten to write off Nigeria for a number of reasons. One, and perhaps most oft cited, the economy is simply too large to be ignored. The state of Lagos alone, with an economy estimated at about US$ 131.0 billion in size, is just about as large as the economies of Kenya ($63.4 billion) and Ethiopia ($61.5 billion) put together. Two, the country’s non-oil economy has been expanding at a relatively robust pace, averaging 6.1 per cent between 2011 and 2015 against 4.7 per cent for the entire economy (IMF data), casting a favourable outlook on efforts to rebalance the growth engine away from oil, potentially creating a buffer against the recurrence of commodity-related shocks in the decades to come.

The article was written by Julians Amboko, a Research Analyst with StratLink Africa Ltd, a Nairobi-based financial advisory firm focusing on emerging and frontier markets, published in the LSE Business Review magazine of the London School of Economics.

Athekame Kenneth liked this on Facebook.

9/22/2016 at 18:17:37 Regards from danglekatangul

9/24/2016 business247ng.com does it again! Quite a informative site and a well-written post. Nice work!

LIke your site. Do you want to trade links.

9/27/2016 business247ng.com does it again! Quite a thoughtful site and a good post. Thanks!

Excellent website you have here but I was curious if you knew of any user discussion forums that cover the same topics discussed in this article? I’d really like to be a part of online community where I can get comments from other experienced people that share the same interest. If you have any recommendations, please let me know. Bless you!

Like business247ng.com– extremely informative and lots to see!

9/29/2016 business247ng.com does it again! Quite a interesting site and a thought-provoking post. Thanks!

9/30/2016 Love the site– extremely easy to navigate and much to explore!

10/2/2016 business247ng.com does it again! Quite a perceptive site and a well-written post. Thanks!

business247ng.com does it again! Quite a thoughtful site and a well-written article. Nice work!

10/9/2016 In my estimation, business247ng.com does a great job of covering topics of this kind. While ofttimes intentionally polemic, the material posted is generally well researched and challenging.

I must express my thanks to the writer for bailing me out of such a challenge. Just after searching throughout the online world and getting thoughts which are not productive, I figured my entire life was gone. Being alive without the approaches to the problems you’ve solved by means of your main guide is a critical case, and the ones which could have badly affected my career if I had not discovered your web blog. The natural talent and kindness in maneuvering a lot of stuff was vital. I’m not sure what I would’ve done if I hadn’t encountered such a subject like this. I can at this time relish my future. Thank you so much for this reliable and amazing guide. I will not think twice to propose your web blog to anyone who needs to have tips about this situation.

Excellent read. I just forwarded this on 10/12/2016 to a fellow student who’s been doing a little research of his own on the topic. To say thanks, she just bought me a drink! So, let me express my gratitude by saying: Cheers for the meal!

Its like you read my mind! You seem to know a lot about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but instead of that, this is excellent blog. A fantastic read. I’ll certainly be back.

10/17/2016 @ 21:59:40: business247ng.com does it again! Very interesting site and a well-written post. Thanks!

Wow! Thank you! I always needed to write on my website something like that. Can I implement a portion of your post to my website?

Like the site– extremely informative and lots to see!

I more or less share your take on this subject and look forward to additional posts and comments here at business247ng.com. Thanks!

I together with my friends appeared to be following the great guidelines on your website and all of a sudden developed a terrible suspicion I never thanked the website owner for those secrets. Most of the people are already certainly thrilled to learn all of them and already have extremely been tapping into them. Many thanks for indeed being simply helpful and for having this sort of magnificent areas millions of individuals are really desirous to be informed on. My honest apologies for not expressing appreciation to sooner.