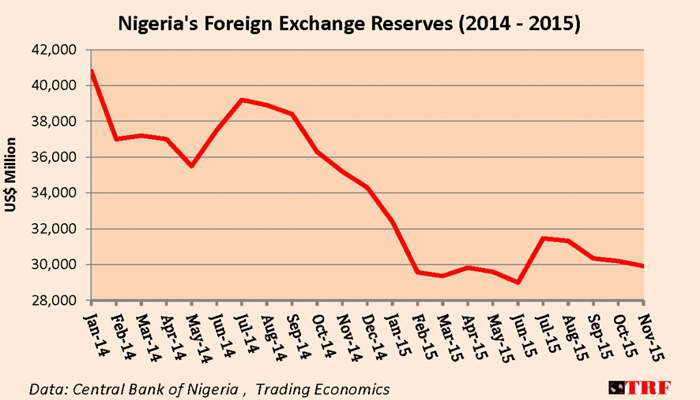

Nigeria’s external reserves dip to $24bn mid-Oct, says CBN

The report from the Central Bank of Nigeria (CBN) has shown that Nigeria’s external reserves has dipped to $24 billion (as at 18th October 2016), just as Depository Corporations Survey for September shows that broad money supply in Nigeria increased month-on-month (m-o-m) by 2.25 per cent to N22.13 trillion.

Business247 News Online notes that the growth in broad money is as a result of a 2.62 per cent growth in net domestic assets to N14.39 trillion accompanied by a 1.56 per cent rise in net foreign assets to N7.74 trillion.

It further showed that the boost was mostly due to a 9.23 per cent m-o-m increase in demand deposits to N8.47 trillion coupled with a 7.88 per cent m-o-m increase in currency (in circulation) outside banks to N1.48 trillion.

Currency in circulation is currency that is physically used to conduct transactions between consumers and businesses rather than stored in a bank, financial institution or central bank.

Analysis of the figures further revealed that the stock of the national reserves lost about $270 million in the last one week from $24.23 billion to a new low of $23.95 billion. It has also lost about $920 million in the last one month from $24.87 billion.

Market watchers said the demand for foreign exchange is still bigger than the supply and within these periods, prices and production have been hovering as well.

The Director-General of the West African Institute for Financial and Economic Management, Prof. Akpan Ekpo, said the cause of the depletion amid relative stable price and production is still the case of demand and supply.

“You cannot plan with uncertainty. What the government can do at best now is to ration. It cannot also stop entirely from spending the ones that came in. It is a matter of the quantity that came in and the quantity the people are asking for. If you spend and do not replenish more than you spent, the reserves will definitely lose level,” he said.

However, Afrinvest, a Lagos based investment advisory group said the impact of an upfront payment from India on the external reserves will result in additional three months of import cover (at the prevailing average import levels), which might also reduce speculative tendencies in the foreign exchange (FX) market.

According to the company, as India and Nigeria continue to share a thriving relationship in the Oil & Gas space in which India remains one of the top importers of Nigeria’s crude there is hope of recovery of the reserves.

The duo recently entered into an agreement for $15 billion upfront Crude Oil Purchase Agreement from Nigeria.

According to investment bankers at Afrinvest West Africa Limited, the deal (if eventually consummated) will guarantee off-take of Nigerian crude in a market already oversupplied and with active explorations on-going in various regions set to add to supply, while the industry still faces competition from alternative energy sources.

Also, “with Nigeria’s external reserves at $24 billion, an inflow of $15 billion in upfront payment for crude purchase will not only provide dollar earnings to shore up the external reserves, it will also provide the Federal/Sub-National Governments with the needed funds that the economy earnestly requires to stabilize domestic fiscal conditions and current account deficits.