Brokers reject implementation of FRC code on tenure limits

By Abdul Olalekan

The President, Nigerian Council of Registered Insurance Brokers(NCRIB), Mr. Kayode Okunoren, said the implementation of the Corporate Governance Code of the Financial Reporting Council of Nigeria (FRC) in the insurance brokerage industry will create a big vacuum as well as threaten the continual existence of insurance broking firms.

Okunoren, who stated this at the 2016 National Insurance Conference & Exhibition of NCRIB in Abuja, Federal Capital Territory, noted that although the brokers are aware of the need for strong corporate governance rules in ensuring sanity in business, the application of the rules with regards to tenure limits for CEOs of insurance broking firms who have more than eight staff members in their companies would do the economy no good. Insurance broking firms, he said, are professional institutions like the law firms, or the accounting firms, where services are personalised or based on the expertise of a few professionals within the organisation.

According to him, “We have instances where there are just two to three core insurance professionals in some broking firms, but with more than 15 support or non-technical staff. Asking the Managing Director or and the Executive Director to leave such companies on the attainment of 10 years in office will create a big vacuum as well as threaten the continual existence of such firms.”

While hoping that FRC would continue to be open to more constructive dialogue that would further make the rules more amenable to change or moderation, in view of the peculiarity of the Nigerian economy, he added that the fact that the insurance industry is still quite fragile and challenged by insufficient manpower, means implementation of this code will create more harm than good for the insurance industry.

The Federal Government had told the FRC to suspend the implementation of the code, at least for now, following heavy criticism that followed its proposed implementation.

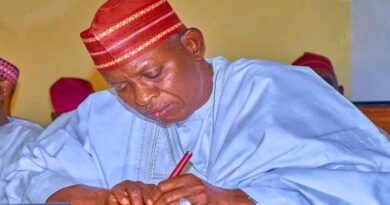

L-R: Deputy President of the Nigerian Council of Registered Insurance Brokers (NCRIB), Mr. Shola Tinubu; former Minister of State for Finance, Mr Remi Babalola, and the President of the NCRIB, Mr Kayode Okunoren discussing at the 2016 National Insurance Brokers Conference and Exhibitions held in Abuja, at the weekend.