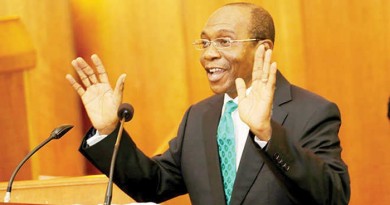

Electronic transactions hit N40.5trn in 2016- CBN

The Central Bank of Nigeria (CBN) has disclosed that value of electronic transaction in the banking sector crossed the N40 trillion threshold to N40.5 trillion in 2016 to reflect the growing public confidence in the system as a result of the convenience of electronic transactions and sensitization.

The Financial System Stability Report (FSSR) by CBN said the volume of electronic transactions rose to 538 million at end of December 2016, a 33.3 per cent increase from 403 million as at the second half of 2016.

The report noted that growth of instant payments continued during the review period as volume and value increased to 97 million and N21.7 trillion in the second half of 2016 from 56 million and N16 trillion, in the first half of 2016, respectively.

“The increase was due to bank customers’ preference for instant settlement,” FSSR stated.

According to the report, “During the review period, the volume and value of Point of Sale (PoS) transactions increased to 38 million and N450.52 billion at the end of 2016 from 25 million and N308.47 billion at second half of 2016, representing an increase of 51.46 and 46.05 per cent, respectively.

“The increase was attributed to the growing number of merchants that accept POS payments, incentives programmes and better network availability.

“The volume and value of mobile payments increased from 22 million and N303.53 billion at second half of 2016 to 24 million and N453.37 billion as at end of December 2016, representing an increase of 6.96 and 49.37 per cent, respectively. The improvement was due to the growing public awareness of the system.

“The volume and value of cheques increased to five million and N2.9 trillion at end-December 2016 from 5.7 million and N2.89 trillion at end-June 2016, reflecting an increase of 4.47 per cent and 1.38 per cent, respectively,” the FSR of stated.

Through the CBN’ RTGS System, the volume and value of inter-bank fund transfers increased to 612,843 and N188,273 billion in 2016 from 546,283 and N183,365 billion as at second half of 2016, representing an increase of 12.18 and 2.68 per cent, respectively.

“The increase was largely attributable to bulk upload of government payments through the System,” the report said.

According to the report, 27,689,678 individuals bank customers had been registered in the Biometric Verification Number (BVN) database and 39,312,797 accounts linked with BVN out of 60,878,449 active customer bank accounts in the country.

The FSSR explained that CBN in 2016 allowed Savings Account Customers with BVN to deposit cheques not more than N2 million in value into their accounts, per customer, per day and CBN exposed a draft Framework to stakeholders for watch-listing any fraudulent customer in the banking industry using the BVN database.

“The implementation of BVN has impacted positively in ensuring the safety of the Nigerian Payments System. Law Enforcement Agencies continued to leverage on BVN to fast-track investigation of financial and other related crimes while other stakeholders used it as credible means of customer identification and authentication,” the report by CBN added.