NSE All-Share Index down 2.09% for the week

The Nigerian Stock Exchange (NSE) All-Share Index depreciated by 2.09 per cent this week while the Market Capitalization appreciated by 0.04 to close the week at 38,436.08 and N13.678 trillion respectively.

In addition, all other indices finished lower during the week with the exception of the NSE Consumer Goods, NSE Oil/Gas and NSE Lotus II Indices that appreciated by 0.68 per cent, 4.54 per cent, and 0.71 per cent respectively while the NSE ASeM closed flat.

Sixteen (16) equities appreciated in price during the week, lower than forty-seven (47) of the previous week. Forty-six (46) equities depreciated in price, higher than twenty (20) equities of the previous week, while one hundred and ten (110) equities remained unchanged higher than one hundred and five (105) equities recorded in the preceding week.

A turnover of 1.852 billion shares worth N51.523 billion in 23,863 deals were traded this week by investors on the floor of the Exchange in contrast to a total of 3.316 billion shares valued at N36.451 billion that exchanged hands last week in 29,771 deals.

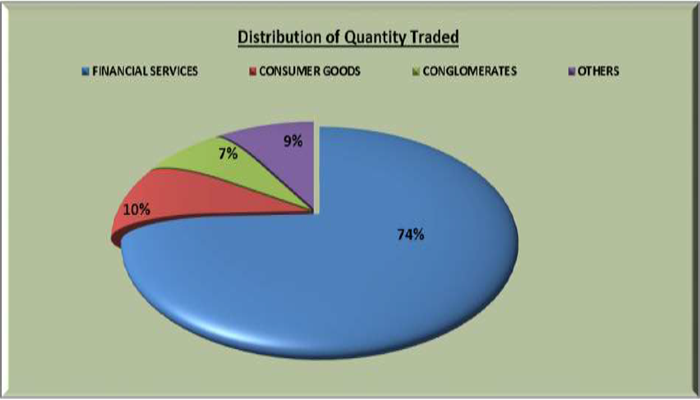

The Financial Services Industry (measured by volume) led the activity chart with 1.377 billion shares valued at N17.137 billion traded in 14,334 deals; thus contributing 74.35 per cent and 33.26 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 175.880 million shares worth N8.044 billion in 4,882 deals. The third place was occupied by Conglomerates Industry with a turnover of 134.882 million shares worth N821.653 million in 1,108 deals.

Trading in the top-three equities namely – Zenith International Bank Plc, FBN Holdings Plc and Diamond Bank Plc (measured by volume) accounted for 632.027 million shares worth N8.494 billion in 5,616 deals, contributing 34.13 per cent and 16.49 per cent to the total equity turnover volume and value respectively.

Also traded during the week were a total of 1,120 units of Exchange Traded Products (ETPs) valued at N14,179.00 executed in 4 deals, compared with a total of 1.189 million valued at N11.662 million that was transacted last week in 30 deals.

A total of 5,382 units of Federal Government Bonds valued at N5.680 million were traded this week in 17 deals, compared with a total of 5,240 units valued at N4.406 million transacted last week in 23 deals.

A total volume of 72,424 and 183,807 units of 12.091% FGNSB NOV 2019 and 13.091% FGNSB NOV 2020 respectively were admitted to trade at the Exchange on the 15th of December, 2017.

Seven Funds created by Stanbic IBTC Asset Management Limited namely; the Stanbic IBTC Money Market Fund, Stanbic IBTC Bond Fund, Stanbic IBTC Balance Fund, Stanbic IBTC Imaan Fund and Stanbic Umbrella Fund were listed by the Exchange on the 11th of December, 2017 for memorandum purpose.