Zenith Bank committed to delivering superior returns – Ovia

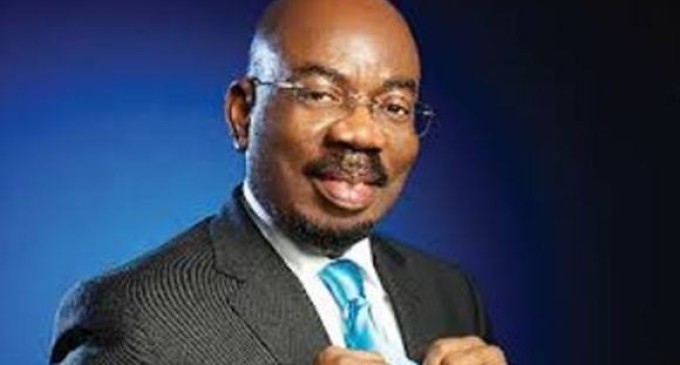

The Chairman of Zenith Bank Plc, Mr. Jim Ovia, yesterday has assured shareholders that the bank remains committed to delivering superior returns, by ensuring that a good chunk of its profit is set aside to reward investors.

Ovia, said this during the financial institution’s 28th Annual General Meeting held in Lagos on Tuesday.

Shareholders at the meeting approved the dividend of 280 kobo per share for the year ended December 31, 2018, that was earlier recommended by the board of directors.

Zenith Bank’s total deposits was N2.82 trillion for the year ended December 31, 2018, representing a 2.9 per cent increase over the previous year’s figure of N2.74 trillion. Its profit before tax rose by 13.6 per cent, from N169 billion in 2017, to N192 billion in 2018.

The bank’s profit after tax rose by 7.8 per cent, from N153 billion in 2017 to N165 billion in 2018. During same period, its total assets grew by 2.7 per cent, from N4.83 trillion to N4.96 trillion; while shareholders’ fund declined by 3.3 per cent, from N698 billion to N675 billion. Gross earnings similarly declined by 20.2 per cent, from N674 billion in 2017, to N538 billion.

Ovia said ‘the bank remains a clear leader in the digital space, with several firsts in the deployment of innovative products, solutions and an assortment of alternative channels that ensure convenience, speed and safety of transactions.

“In order to continue to cater to the varied appetites of our customers in a constantly changing world and stay ahead of the competition, therefore, we have invested massively in new technologies and innovative solutions in the last financial year.

“This is geared towards ensuring that we continue to provide best in class quality services that create value for all our stakeholders,” he said.

He pointed out that in 2018, Zenith Bank made significant progress in its adoption and integration of sustainable banking principles into its business, especially in its credit administration process.

Commenting on his outlook for 2019, the Zenith Bank’s chairman said: “The beacon of optimism in the outlook for 2019 is the gradual improvement in the performance of the non-oil sectors and their contribution to the Gross Domestic Product, which is expected to continue in the short to medium term.

“The major downsides to Nigeria’s growth outlook for 2019, are significant fall in global crude oil price and disruption to optimal oil production.”

On his part, the meeting, the Group Managing Director/Chief Executive Officer, Zenith Bank, Mr. Peter Amangbo, pointed out that since its inception, Zenith Bank has been synonymous with innovation and the deployment of cutting-edge technology to cater to the expectations of its customers.

“Our array of products, services and alternative channels that ensure convenience state-of-the-art technology has assured that we maintain our leadership in the digital space.

“As a customer-centric organisation, our people are the most valuable asset that is vital to our long-term sustainable success, competitive advantage and brand differentiation strategy.

“The skills, experience and commitment of our employees are for stakeholders’ engagement and delivery of exceptional services to our customers. Consequently, our focus in the year ahead is to continually create and environment for our people to thrive, while creating value for stakeholders,” he added.

Representatives of various shareholders’ associations, who attended the meeting, commended the bank for the impressive financial performance.

The National Coordinator Emeritus, Independent Shareholders Association of Nigeria (ISAN), Sir. Sunny Nwosu, hailed the bank for continuously creating value for all its shareholders.

Credit: Thisday