Nigerian bourse: Investors stake N26.01bn for the week

A total turnover of 1.814 billion shares worth N26.008 billion in 23,494 deals were traded last week by investors on the floor of the Nigerian Stock Exchange (NSE), in contrast to a total of 1.547 billion shares valued at N24.263 billion that exchanged hands upper week in 21,646 deals.

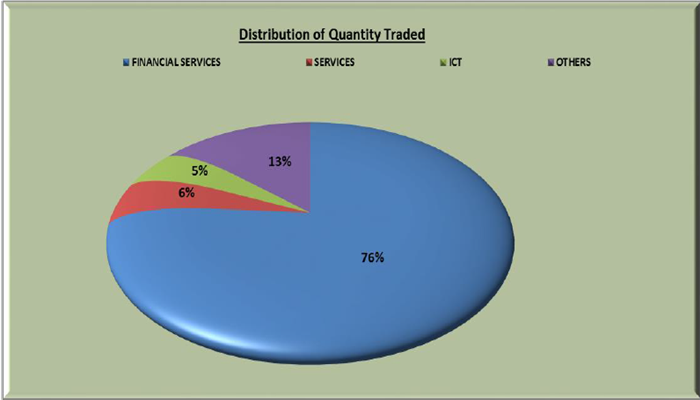

The Financial Services industry (measured by volume) led the activity chart with 1.382 billion shares valued at N16.909 billion traded in 16,275 deals; thus contributing 76.20% and 65.02% to the total equity turnover volume and value respectively.

The Services followed with 98.557 million shares worth N263.837 million in 369 deals. The third place was ICT industry, with a turnover of 89.782 million shares worth N598.016 million in 800 deals.

Trading in the Top Three Equities namely, Guaranty Trust Bank Plc, Zenith Bank Plc and United Bank for Africa Plc (measured by volume) accounted for 784.482 million shares worth N14.610 billion in 9,337 deals, contributing 43.25% and 56.17% to the total equity turnover volume and value respectively.

A total of 8,193 units valued at N68.491.03 were traded this week in 11 deals, compared with a total of 8,250 units valued at N69,155.40 transacted last week in 14 deals.

A total of 61,750 units of Federal Government Bonds valued at N69.995 million were traded this week in 27 deals, compared with a total of 6,321 units valued at N7.194 million transacted last week in 28 deals.

The NSE All-Share Index and Market Capitalization appreciated by 0.24% and 0.27% to close the week at 26,279.61 and N13.695 trillion respectively.

All other indices finished higher with the exception of NSE Main Board, NSE Pension, NSE AFR Div Yield, NSE MERI Growth, NSE Consumer Goods, NSE Lotus and NSE Industrial Goods indices which depreciated by 1.34%, 0.91%, 0.91%, 2.36%, 5.87%, 2.28% and 4.27% while NSE ASeM Index closed flat.

Thirty-six (36) equities appreciated in price during the week, higher than Six (6) equities in the previous week. Twenty- five (25) equities depreciated in price, lower than fifty-eight (58) equities in the previous week, while one hundred and two (102) equities remained unchanged, higher than ninety-nine (99) equities recorded in the preceding week.