COVID-19: NB posts declined EPS of 98.4% for Q2, 2020

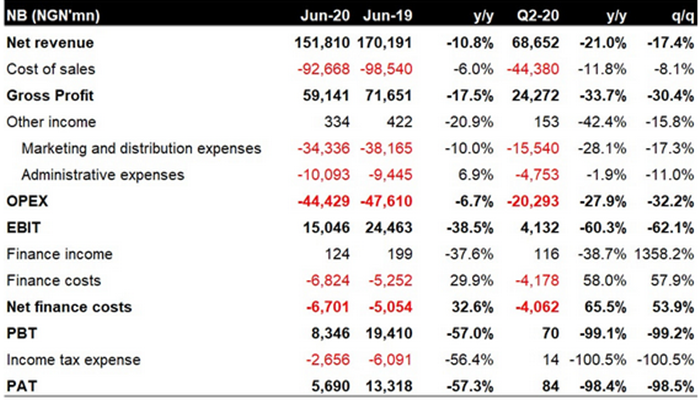

Nigerian Breweries Plc’s first half unaudited result for 2020, published on The Nigerian Stock Exchange (NSE) last week shows earning per share (EPS) decline of 57.3 per cent year-on-year. For the three months ended June (Q2), EPS declined 98.4 per cent year-on-year. EPS was impacted by lower revenue, weaker margins and higher finance costs.

Its gross revenue declined by 21.0 per cent year-on-year as against a decline -10.8 per cent in the first quarter of the year, the largest decline on record, as volumes were negatively impacted by the imposition of lockdowns across major cities in Nigeria.

There was significant demand destruction as on-trade sales channels (hotels, bars, restaurants, clubs, etc), which account for c.64.0 per cent of beer industry sales, were effectively cut off as these businesses shut down operations during the quarter.

Supply was also affected due to a COVID-19 induced ban on the distribution of alcoholic beverages for much of the quarter. On a quarter-on-quarter basis, net revenue declined 17.4 per cent.

Gross profit margin printed 35.4 per cent in Q2-20, 675 basis points lower than in Q2-19, and the weakest reading since quarter three of 2018. The margin compression is indicative of a slowdown of volumes in the premium segment amidst the disruption in on-trade sales, as well as the inflationary impact on input costs – COGS was upwardly sticky, declining by only 8.1 per cent, much slower than revenue.

Consequently, earnings before interest and taxes (EBIT) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) declined by 60.3 per cent and 27.9 per cent respectively, as the topline plunge offset the decline in marketing and distribution by 28.1 per cent and admin 1.9 per cent expenses.

Notably, the OPEX-to-sales ratio declined marginally (-88bps) during the period, showing strong cost management and operational efficiency by the company. EBITDA margin also remained resilient, coming in at 19.6% (vs 21.4% in Q2-19 and 23.8% in Q1-20).

Elsewhere, net finance cost grew by 65.5 per cent year-on-year, following a NGN59.86billion increase in bank overdrafts during the period. PBT declined by 99.1 per cent. However, following a NGN14.15million tax credit during the period, PAT printed NGN84 million, representing a 98.4 per cent decline.

Analysts at Cordros Capital are of the view that Nigeria Breweries’ performance expectedly reflects the challenging operating environment which is due to the COVID-19 pandemic.” Following the relaxation of the lockdown and the imminent reopening of some on-trade channels, we expect a gradual recovery in H2. Our estimates are under review”, the company said..