FG leveraging fintech innovation to address agric, energy challenges – Osinbajo

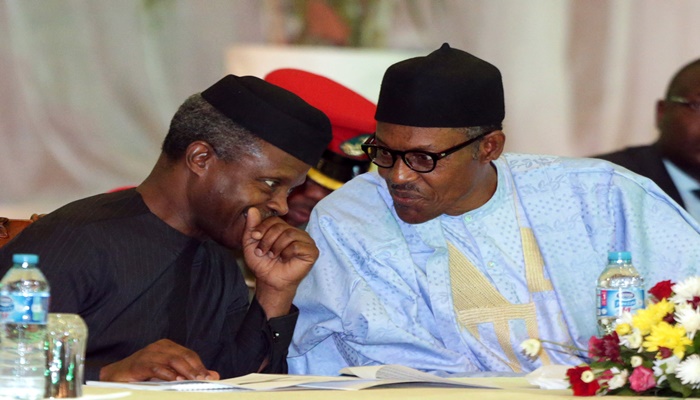

Leveraging the innovative capacity of Fintechs, the Buhari administration is accelerating interventions, especially those under its Economic Sustainability Plan (ESP), including programmes on renewable energy, agriculture, improving access to credit and direct cash transfers, among others, according to Vice President Yemi Osinbajo, SAN.

Prof. Osinbajo stated this Friday at the official launch of the Nigeria Sustainable Development Goals (SDGs) Fintech Hackathon organized by Financial Centre for Sustainability Lagos (FC4S Lagos), Nigeria Climate Innovation Centre (NCIC), Access Bank and AfricaHacks.

According to the Vice President, “this is incredibly powerful for our efforts at resolving the climate crisis; transitioning to cleaner energy but also it introduces a tremendous opportunity for Fintech companies for payments systems.

“Being able to manage that whole process, collect monies in some case, and in many cases, payout to owners. I think that there are tremendous opportunities there. This is something we are starting now. Of course, several companies have already shown some interest.

“So, as we address climate concerns, there are major opportunities for Fintech companies and their creativity is going to be very crucial here.”

Speaking about leveraging innovations by Fintechs to address challenges in agriculture, the Vice President said “we need to expand the scope of sustainable farming and farming techniques.”

His words: “this has become crucial because we realise that now with deforestation and all the issues with farmer-herder clashes and all of that, there is a need for us to look more closely at how to be more creative with the farming technique, engage our farmers, educate our farmers, use more extension workers actively. And I found this to be the case especially as we are trying to implement an aspect of our Economic sustainability plan.

“So, we have to first find out where these new farmers work and we have to geo-tag them to their farms. But more importantly, we had to get credit to them one way or the other because many of them are in far-flung areas of the country.

“But not just credit, also information that they would need for choosing the right type of fertilizer, and other farm input. There is no question at all that Fin-Tech is crucial and would even be more crucial especially as we pursue goals of financial inclusion and trying to reach hitherto unreachable parts of the country.”

Continuing, Prof. Osinbajo said, “there is no way of addressing the issues of poverty and all the issues around the SDGs if we are not able to reach those that need to be reached with credit.”

In ensuring a smooth transition to clean energy, the Vice President said “it requires somebody who is able to facilitate movement of money quickly and this is the sort of thing we hope Fintech companies would do especially as we expand the scope of the transition to clean energy to LPGs all across the country.”

The Vice President enjoined young Nigerians to aspire to achieve their dreams and take advantage of the exciting opportunities that abound in the tech systems.

The Naija SDGs Hackathon aims to facilitate the development of Fintech solutions that have a direct impact on the realization of the SDGs. Top teams will be supported by institutions to scale these solutions to become Fintech success stories in Nigeria.

Guests at the launch event include the Senior Special Assistant to the President of Nigeria on Sustainable Development Goals (SDGs), Mrs Adejoke Orelope-Adefulire; the Special Adviser to the Lagos State Governor on Sustainable Development Goals (SDGs), Mrs Solape Hammond; the former Special Adviser to the UK Prime Minister on Social Justice, Young People & Opportunities, Mr Nero Ugwhujabo; the CEO of FMDQ Group and Chairman of Financial Centre for Sustainability Lagos (FC4S Lagos), Mr Bola Onadele; Deputy Managing Director of Access Bank, Mr Roosevelt Ogbonna; Chairman/CEO of Nigeria Climate Innovation Centre (NCIC), Mr Peter Bamkole, and Co-Founder, AfricaHacks, Ms. Christine Dikongue, among others.