Lafarge shareholders approve N140bn Rights Issue

Shareholders of Lafarge Africa Plc, has agreed to issue up to a rights issue up to N140 billion to existing shareholders.

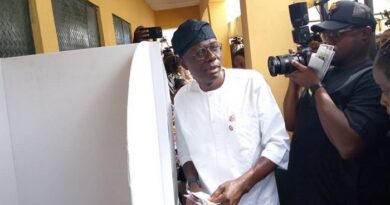

Shareholders of Lafarge Africa at the Annual General Meeting (AGM) on Wednesday in Lagos noted that the right issuance was a right decision but however the rights of the minority shareholders should be protected.

The former President, Independent Shareholders Association of Nigeria (ISAN), Sir Sunny Nwosu noted that the fear of Nigerian shareholders on the right issuance was informed by Ashaka Cement delisting experience.

According to him, “I will like this board to give us an undertaking that they will not cross their present 72.59 per cent, even upon the Rights Issue. I’m not going to say no to the issue provided we understand ourselves, to agree that Lafarge will peg her equity to 72.59 per cent and give us the comfort of our own percentage” he said.

Speaking earlier on the Rights Issue, the first since 2005, Mobolaji Balogun, Chairman of the Board of Directors, noted that the decision of LafargeHolcim, its largest shareholder, to convert existing loans into equity “demonstrates the Group’s continued belief in the Nigeria story,” adding that this “is the largest Rights Issue and the largest investment in a listed company by an investor.”

“The company is embarking on a Rights Issue to reduce its exposure to adverse foreign currency translation losses as experienced in 2016 following a 40 per cent depreciation of the Naira against the US Dollar.

He, however, assured shareholders that their equity was protected, while urging them to follow their rights as that was the way to ensure that the right is fully subscribed, thus ensuring that the company is well positioned for growth.

While listing the benefits of recapitalisation, the Chairman said, “It reduces our foreign currency exposure by 50 per cent. The remaining portion of the debt, with the support from LafargeHolcim, has been refinanced and hedged for 12 months.

Speaking at the AGM, Michel Puchercos, Country CEO of Lafarge Africa stated that the acquisition of Unicem in 2016 was in line with the Company’s capacity expansion plans. He noted that doubling of the production capacity of the Mfamosing plant in Calabar to 5 million metric tons per annum has “contributed significantly to Lafarge Africa’s capacity and footprint in Nigeria; provides an opportunity to increase our share of the cement market in the South East and South regions, and has begun to impact positively on the financial results of the Company.”

Commenting on the contribution of Unicem to the company’s 2016 performance, the Country CEO said, “Mfamosing line 2 was delivered ahead of time and above specification, it’s now fully operational. It contributed to Q4 2016 cement production volume and going forward it’s expected to deliver significant cost savings.

The Rights Issue process will be launched once shareholders have approved the transaction at the Annual General Meeting. The subscription will take place beginning of third quarter and is expected to be finalised by October at the latest. LafargeHolcim will subscribe to its rights by converting the existing debt into equity.