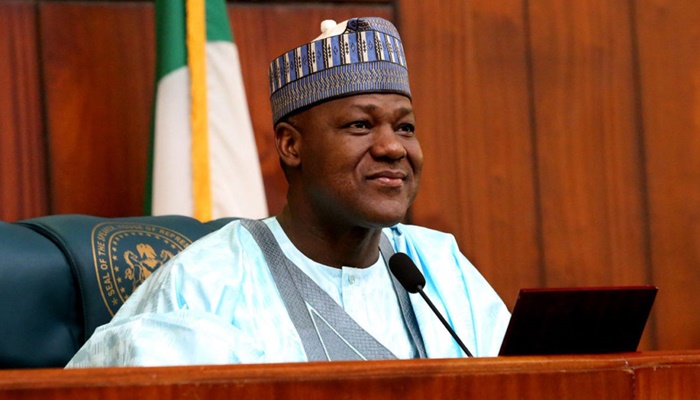

The decision to change the ownership structure of the Nigerian Stock Exchange (NSE) was to open up the capital market, Speaker of the House of Representatives, Yakubu Dogara, explained.

The Speaker said the decision was also to make the market conform to global best practices, to make it more attractive to investors.

Last week, the House adopted the recommendations of a report by its Committee on Capital Market and Institutions, Chaired by Yusuf Tajudeen on a Bill for an Act to facilitate the development of Nigeria’s Capital Market.

The Bill will enable the conversion and re-registration of the NSE from a company limited by guarantee to a public company limited by shares and for related matters.

Special Adviser on Media & Public Affairs to the Speaker, Mr. Turaki Hassan, said on Monday in a statement the change of the ownership structure of the NSE would bring the ordinary Nigerian closer to benefiting from the nation’s commonwealth.

He said this would make more multinational corporations get their companies listed, thereby contributing to the development of the country’s economy.

Also, when concurred to by the Senate and signed into law by the President, he said the changes made by the House would bring more involvement of investors in governance.

Hassan said the new arrangement would equally bring a flexible governance structure in the capital market, to make it easy for decision to be made in response to changes in the business environment.

The change in the market structure would also afford investors increased access to resources for capital investment by way of equity offerings or private investment to raise funds.

In June 2016, while performing the closing gong during his visit to the stock exchange in Lagos, Mr. Dogara pledge to use legislative tools to reposition the capital market for maximum performance.

He had described as unacceptable a situation where a large portion of the country’s resources or capital was heavily concentrated in the hands of few chief executive officers, CEOs of companies.

This situation, the Speaker pointed out, further widened the inequality gap, eliminates the middle class and plunges more people into abject poverty, thereby posing serious threat to the sustenance and survival of democracy.

Deepening of Nigeria’s capital market, he said, would enhance wealth redistribution and deliberately allow it to trickle down to the ordinary people as against the practice where multinational corporations repatriate their profits 100 percent to their own countries without investing back to the Nigerian economy.

The Bill would soon be transmitted to the Senate for concurrence.