Nigerian bourse down 2.85% for the week

The Nigerian Stock Exchange (NSE) All-Share Index and Market Capitalization depreciated by 2.85 per cent and 3.26 per cent to close the week at 41,935.93 and N15.002 trillion respectively last week.

Similarly, all other indices finished lower during the week with the exception of the NSE Insurance Index that appreciated by 0.25 per cent.

A total turnover of 2.444 billion shares worth N36.665 billion in 26,712 deals were traded last week by investors on the floor of the Exchange in contrast to a total of 3.079 billion shares valued at N39.990 billion that exchanged hands the upper week in 23,086 deals.

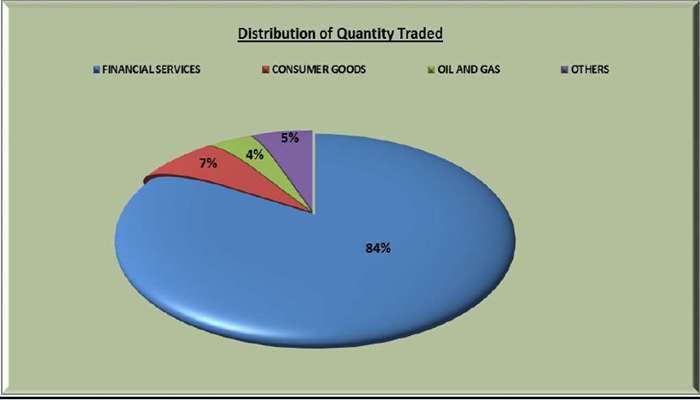

The Financial Services Industry (measured by volume) led the activity chart with 2.044 billion shares valued at N26.330 billion traded in 16,788 deals; thus contributing 83.61 per cent and 71.81 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 168.973 million shares worth N8.111 billion in 4,927 deals. The third place was occupied by Oil and Gas Industry with a turnover of 94.742 million shares worth N825.871 million in 1,641 deals.

Trading in the top three equities namely – FBN Holdings Plc, Zenith International Bank Plc and Fidelity Bank Plc (measured by volume) accounted for 1.084 billion shares worth N17.852 billion in 7,074 deals, contributing 44.34 per cent and 48.69 per cent to the total equity turnover volume and value respectively.

Also traded during the week were a total of 1.889 million units of Exchange Traded Products (ETPs) valued at N10.512 million executed in 4 deals, compared with a total of 50,547 units valued at N4.593 million that was transacted last week in 12 deals.

A total of 40,566 units of Federal Government Bonds valued at N44.313 million were traded this week in 29 deals, compared with a total of 6,574 units valued at N6.332 million transacted last week in 31 deals.