The Nigerian Stock Exchange (NSE) All-Share Index and Market Capitalization depreciated by 2.54 per cent to close the week at 30,874.17 and N11.271 trillion respectively.

Similarly, all other indices finished lower with the exception of the NSE ASeM, NSE Insurance and NSE Consumer Goods Indices that finished higher by 0.09 per cent, 4.71 per cent and 0.08 per cent respectively.

A total turnover of 1.199 billion shares worth N14.277 billion in 15,841 deals were traded last week by investors on the floor of the Exchange in contrast to a total of 1.282 billion shares valued at N23.142 billion that exchanged hands upper week in 11,467 deals.

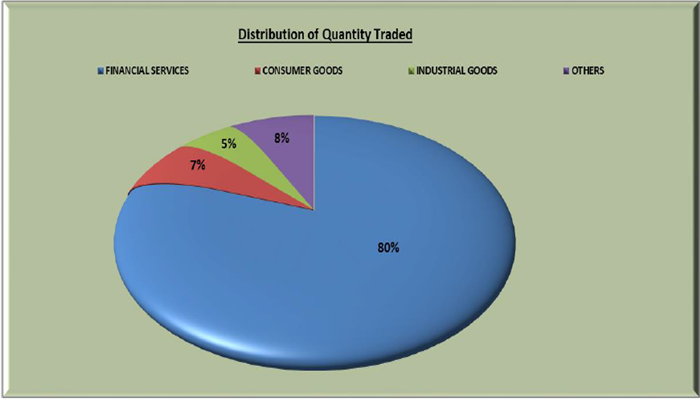

The Financial Services Industry (measured by volume) led the activity chart with 963.315 million shares valued at N7.536 billion traded in 8,871 deals; thus contributing 80.38 per cent and 52.79 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 83.001 million shares worth N4.213 billion in 2,802 deals. The third place was Industrial Goods Industry with a turnover of 60.782 million shares worth N1.976 billion in 1,639 deals.

Trading in the top-three equities namely Diamond Bank Plc, Access Bank Plc, and Universal Insurance Plc, (measured by volume) accounted for 512.535 million shares worth N1.367 billion in 1,437 deals, contributing 42.76 per cent and 9.57 per cent to the total equity turnover volume and value respectively.

There was no trade recorded for Exchange Traded Products (ETPs) during the week under review. However, a total of 5,637units valued at N1.301 million was transacted last week in 5 deals.

A total of 16,686 units of Federal Government Bonds valued at N16.442 million were traded this week in 10 deals compared with a total of 3,032 units valued at N3.046 million transacted last week in 16 deals.

Twenty five (25) equities appreciated in price during the week, lower than thirty (30) in the previous week. Forty-one (41) equities depreciated in price, higher than twenty four (24) of the previous week, while one hundred and three (103) equities remained unchanged lower than one hundred and fifteen (115) equities recorded in the preceding week.