By our Correspondent

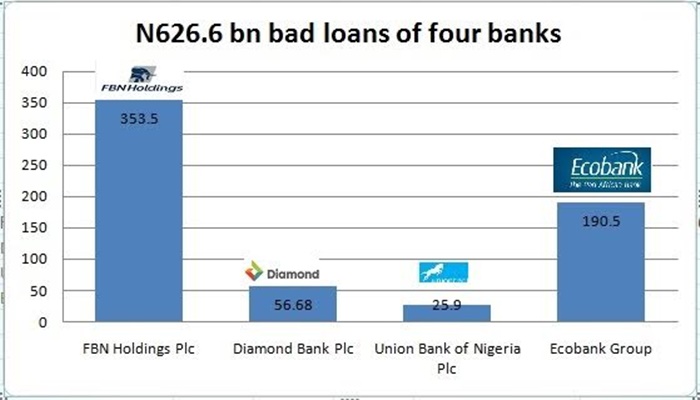

First Bank of Nigeria Holdings Plc (FBN), Ecobank Group Plc and two other banks reported N626.6 billion bad loans in 2015.

Other two banks that contributed to the N626.6 billion bad loans last year are Diamond Bank Plc and Union Bank of Nigeria Plc (UBN).

The Central Bank of Nigeria (CBN) had reported that amount of bad loans in the banking industry stood at N649.63 billion in 2015, indicating severe deterioration in the quality of the loan portfolio of 22 banks operating in the country.

The above four banks contributed 96 per cent of bad loans in 2015 that impacted negatively on profit and dividend payout to shareholders.

According to Business247 investigation, Ecobank Group, a Pan-Africa Bank has the highest bad loans of $967 million (N190.5 billion at N197/$) in 2015, followed by First Bank of Nigeria Holdings that reported N353.5 billion bad loans.

With significant increase in bad loans, FBN Holdings NPL ratio moved from 2.9 per cent in 2014 to 18.1 per cent in 2015, exceeding five per cent Central Bank of Nigeria (CBN) limit.

Ecobank and FBN Holdings Loans & advances customers closed 2015 at N2.23 trillion and N1.82 trillion respectively.

This indicates that nearly nine per cent and 19 per cent of Ecobank and FBN Holdings total loans and advances to customers in 2015 were not performing.

Although, banks in Nigeria recorded a 30 per cent decline in loans and advances to customers in 2015 to N5.78 trillion as Ecobank and FBN Holdings contributed over N4 trillion.

Group Chief Executive Officer, EcoBank, Mr. Ade Ayeyemi in a statement agreed that the group performance in 2015 accounts was disappointing.

He noted that the group was faced with a difficult operating environment due to the slowdown in economic growth across Africa, as a result of lower commodity prices.

Also commenting, the Group Managing Director of FBN Holdings, U.K Eke explained that last year mark a very difficult time in the history of the financial institution.

Eke acknowledged the challenges facing the Group, and promised to restore shareholder value whilst building long-term sustainability.

Further investigation by our correspondent revealed that Diamond Bank accounts for N56 billion bad loans while UBN bad loans’ stood at N25.9 billion in 2015.

According to the CBN report, 18 out the 22 banks recorded increase in bad loans.

Furthermore, the number of banks that exceeded the regulatory limit of five per cent for ratio of bad loans to total loans rose from three in 2014 to eight in 2015, with three banks exceeding 10 per cent.

The report reveals that the ratio of bad loans for the industry relative to total loans rose to 4.88 per cent, which is 1.2 per cent less than the regulatory limit of per cent industry.

Diamond Bank reported a bad loans ratio of 6.9 per cent in 2015 from 5.1 per cent in 2014 while UBN bad loans’ ratio moved from 5.03 per cent to 6.67 per cent in 2015.

The sharp increase in bad loans, according to CBN report was due to a host of external and internal factors.

These include: Low and volatile Oil prices; uncertainty about severe fiscal imbalance at the sub-national level of government; weak output growth; and eroding investor confidence.

Chief Executive Officer, Diamond Bank Plc, Mr Uzoma Dozie, in a statement said, “2015 was undoubtedly a challenging year for us owing to a mixture of external factors not limited to regulatory headwinds and a difficult macroeconomic environment.

“Whilst this led to additional impairment charges following a prudent review, we have further tightened the criteria for loan originations in order to better align our loan portfolio with the macroeconomic conditions. As a result, we are confident that the overall quality of our loan book remains high,” he added.

Comments are closed.