By ABDUL- KHALIQ OLALEKAN

The insurance industry regulator, the National Insurance Commission, (NAICOM) is set to create additional insurance distribution channels to increase insurance penetration in the country.

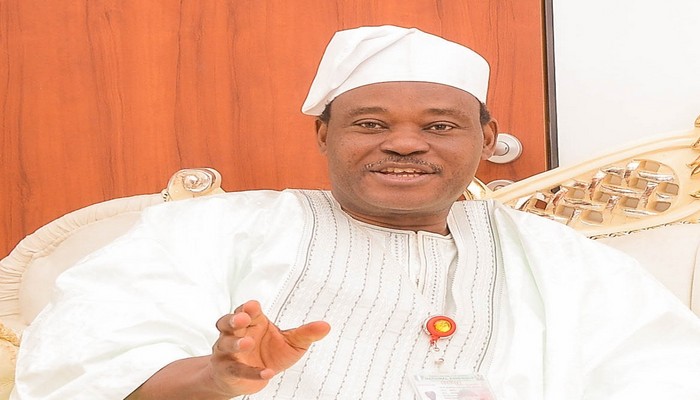

Commissioner for Insurance, Alhaji Mohammed Kari, who stated this at the 2016 Annual Chief Executive Officers retreat of the Nigerian Council of Registered Insurance Brokers(NCRIB) in Ilesha, Osun State recently, lamented the low level of insurance penetration in the country, believing creation of new channels would increase the level of insurance sell out and awareness among Nigerians.

According to him, “We have also identified the limited channels of distribution as a major inhibition factor to penetration. In this regards we have considered the creation of additional distribution channels and have gone far on the preliminary works and draft of guidelines which soon be exposed for input.”

Stating that though, there has been a substantial increase in the number of players and activities in the insurance market, he said the increase in the number of players especially brokers is yet to reflect on the level of insurance penetration in the country.

The only possible explanation for this, he pointed out, could be that intermediaries are not creating new business neither are they expanding their operations beyond the major cities of the country and around a few clients that are already converted insurance consumers.

He felt the penetration would continue to be low if everyone would only operate from the comfort of the metropolis or chase only existing clients with insurance policies.

The regulator’s duty in developing the market, according to him, can be akin to the baker’s baking the cake. “If he decides to bake a flavoured cake, the strawberry, vanilla or chocolate flavour sellers would have to wait for the day he select their flavour. For he cannot bake one cake with all flavours as the consumers would always have their preferences,” he illustrated.

To address this, the commissioner called for development of a good strategy on insurance penetration.

While the newly formed Insurer’s Committee has setup various sub committees to look at that and more issues, he pointed out the regulatory body is complementing those efforts by expanding it’s enforcement of compulsory insurance’s down to the states level.

In the process, he said NAICOM sadly found all sorts of under-the-table arrangements where insurance policies are being offered in conjunction with various state governments to unsuspecting public, sometimes with registered brokers and in most case with unregistered and unlicensed entities.

To him, “This is Illegal, criminal and punishable under the laws of the country. Brokers and underwriters alike should beware as we have beamed our searchlight to that direction. Unrepentant companies and individuals that are engaged in these schemes ‘would answer’ (like we say in the new Nigerian vocabulary).”

The recent economic challenges, he stressed, mounts pressure on the insurance industry to be more flexible and to approach business in a more dynamic fashion. While insurance has always been a highly-regulated industry, he noted that new regulations and legislation are proposed and adopted on a regular basis. Increasing compliance demands from other regulatory bodies require more agile processes that can evolve and adapt on a continuous basis, but that also offer varying levels of control over how they are executed, he disclosed.

Insurance institutions, he implored, must find a way to break out of the silo’ed, legacy systems which perpetuate a limited view of the customer. “New models of business and enterprise architecture need to arise; where integrating with newer technology solutions and affecting process improvements that leverage the capabilities of existing personnel and applications can become the norm,” he pointed out.

Comments are closed.