The Nigerian Stock Exchange (NSE) equities market segment closed the first half of the year with market capitalization gaining N314 billion or 3.2 per cent.

Market capitalization (total value of tradable equities of a publicly traded company) closed June 30, 2016 at N10.165 trillion from N9.851 trillion the market opened in 2015.

The NSE All-Share Index (ASI) (Index that tracks general market movement of all listed equities on the Exchange, including those listed on the Alternative Securities Market (ASeM), regardless of capitalization) closed at 29,597.79 basis points on the last day of June, up from 28, 642.25 basis points at which it opened 2016, representing a growth of 3.34 per cent.

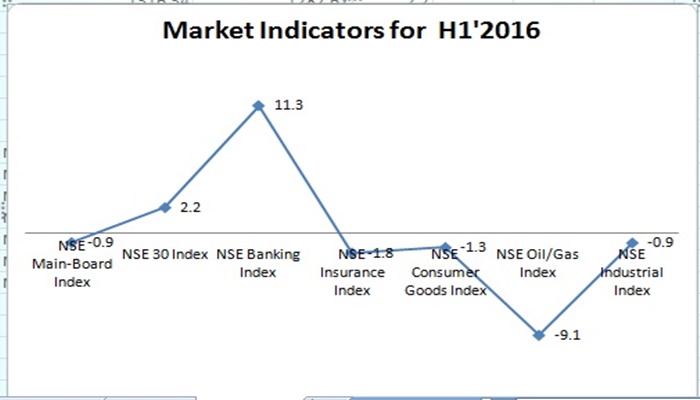

According to data gathered by business247ng, growth in banking shares impacted on NSE Banking that rose by 11.3 per cent in six months while uncertainty in the oil & gas sector continued to weaken listed oil & gas shares as NSE Oil/Gas Index slumped by 9.1 per cent.

NSE Banking Index moved from 268.49 basis points to 298.81 basis points while NSE Oil & gas dropped from 356.56 basis points to 324 basis points as at June 30, 2016.

Analysts at the equities market have attributed the market growth to the new flexible foreign exchange policy of the Central Bank of Nigeria (CBN).

After a long profit-taking caused by unclear polices on exchange rate and Federal Government delayed 2016 budget, the market rebounded weeks before the end of half year, bringing the year-to-date (YTD) growth to the positive.

Other market indicators considered are NSE Industrial that dropped by 0.9 per cent to 2,146.8 basis points from 2,166.7 basis points.

NSE Consumer Goods Index and NSE Insurance Index declined by 1.3 per cent and 1.8 per cent to 736.28 basis points and 140.04 basis points respectively.

Reacting, analysts at Investment one Limited expressed optimism regarding a possible shift to a market-determined exchange rate regime supporting equities market performance.

“We see the impacts of these events on market performance. However, in the medium to longer term, we see improved performance on the back of efficiency gains from an expansionary fiscal policy leading to improvement in aggregate demand,” the company explained in a statement.

In an interview with our correspondent during the weekend, The Managing Director, Enterprise Stockbrokers Plc, Mr. Rotimi Fakayejo, expressed that the equities market has performed remarkably in the first six months of 2016 despite the macro economy challenges.

According to him, “the equities market started woefully but the NSE ASI as at June 30 per cent closed at 3.3 per cent which is remarkable as against a decline of 3.2 per cent last year.”

He was optimistic that the equities market in the remaining half of 2016 would witness the rebound of Foreign Portfolio Investment (FPI), fresh capital injection and proper implementation of CBN’s flexible foreign exchange.

In his words, “the second half of 2016 will be better based on Federal government plans to inject fresh capital into the economy and fully implementation of CBN foreign exchange policy.

“We may begin to see foreign investors returning to the equities market by the end of September which is a recipe for our economy growth. We strongly believe the nation’s economy will take sharp in the second half of the year,” he added.

Comments are closed.