As the nation’s capital market closed on Friay, four financial institutions out of 15 listed on The Nigerian Stock Exchange (NSE) are top performing shares in 30-week of 2016.

These four financial institutions include United Bank for Africa Plc (UBA), Guaranty Trust Bank Plc (GTBank), Zenith Bank Plc and Access Bank Plc.

Despite global and local macro economy challenges, these four banks have maintained stronger fundamentals as indicated in profitability and robust assets quality.

The shares of UBA, GTBank, Zenith Bank and Access Bank have become a toast to investors as the management of these banks adopted a principal of paying shareholders interim and full-year dividend.

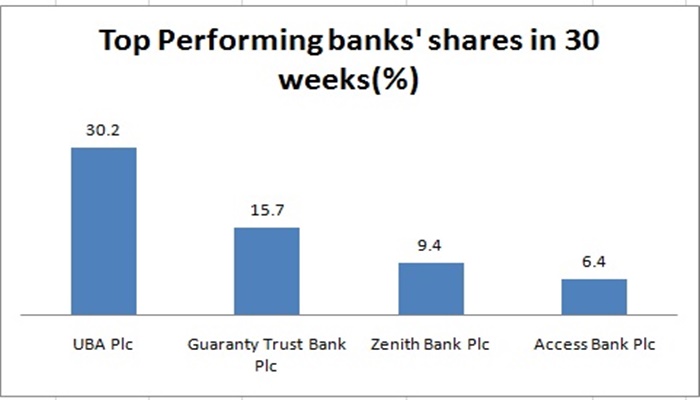

According to Business247 News Online data, the shares of UBA has increased by 30 .2 per cent or N1.02 from N3.38 it opened the year to N4.40 on Friday July 22, 2016 (30-week).

On this instance, Renaissance Capital and CSL Stockbrokers have placed a “Buy” rating on UBA, describing the bank as very attractive with a strong potential to generate returns of more than 100 per cent in the next 12-month period. The “buy” rating on UBA, underlines its attractiveness despite the general downward trend at the stock market.

GTBank, the most highly capitalized bank shares on NSE closed in 30-week with a gain of 15.7 per cent or N2.85 from N18.18 to N21.03 while shareholders that invested in Zenith Bank shares have benefited a 9.4 per cent or N1.32 price appreciation from N14.05 it opened the year to N15.37 equities market closed on Friday.

Furthermore, a share of Access Bank has appreciated by 6.4 per cent or N0.31 to N5.16 as the market closed on Friday from N4.85 it opened this year with.

Some market operators said the strong investment case for UBA, GTBank, Access Bank and Zenith followed the recent affirmation of its credit rating by Fitch Ratings as well as an upgrade by Agusto & Co.

Recent report by Fitch Ratings, a global rating agency, said GTBank remains one of the top two rated banks in Nigeria

The Fitch report on GTBank stated that the bank’s long term Issuer Default Rating (IDR) has moved from negative to stable, citing the bank’s continuing strong earnings, and stronger-than-expected liquidity as the reasons for the revised outlook.

Fitch Ratings also affirmed GTBank Plc’s long-term Issuer Default Rating (IDR) at ‘B+’ with a Stable Outlook and Short-term IDR at ‘B’. In addition, the agency affirmed the bank’s Viability Rating (VR) at ‘b+’, Support Rating (SR) at ‘4’ and GTB Finance BV’s senior notes, guaranteed by Guaranty Trust Bank: affirmed at ‘B+’/’RR4’.

Fitch also upgraded UBA’s outlook to stable from negative, thus reinforcing the strong outlook on the bank, especially as its diversified network across eighteen other African countries make it relatively immune against the potential cyclical volatilities in any of its country of operations.

Also, Agusto & Co, upgraded the bank’s rating from “A+” to “Aa-“, with a stable outlook. According to Agusto & Co, “the rating of UBA is upheld by the bank’s improved capitalsation, good liquidity and large pool of stable deposits, strong domestic presence supported by the Bank’s extensive branch network and growing alternative banking channels.

“We note improvement in profitability and the Bank’s good asset quality. The rating takes into cognizance the weak macroeconomic climate on the banking industry’s asset quality, which we do not expect UBA to be excluded. Nonetheless, we note positively its diversified geographical reach, which will cushion to an extent the impact of the weak Nigerian economic climate,” Agusto & Co stated in its credit rating report.

Early this year, Fitch Ratings had upgraded Access Bank’s long-term national ratings to “A” from “A-” with a stable outlook, a milestone that shows the lender has overcome the macroeconomic headwinds crimping the growth of businesses in Africa’s largest economy.

“Access Bank’s major strengths, which underpin its long- and short-term ratings, include its size and franchise, its strong risk management and the group’s solid capitalisation”, said Fitch in its report.

“The bank’s improved rating further reinforces its resolve to deliver leading innovative and differentiated products and services to its customers, in its quest to become the world’s most respected African bank by 2017,” Fitch report added.

Comments are closed.