Following the Central Bank of Nigeria (CBN) Commission on Turnover reduction to N1 per mille on every N1000, Deposit Money Banks (DMBs) in the country have leverage on income generation using electronic banking.

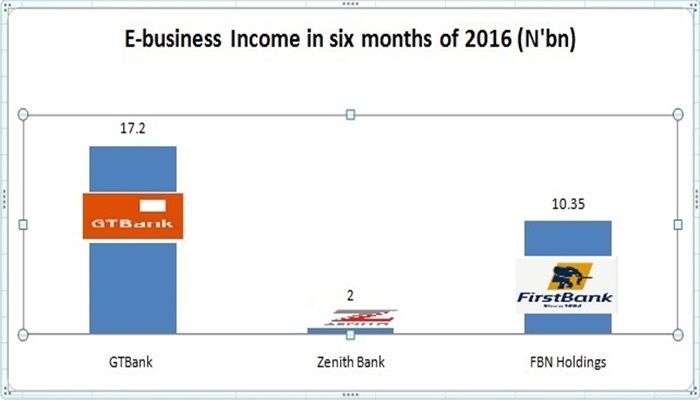

For instance, Guaranty Trust Bank, Zenith Bank Plc and First Bank of Nigeria Holdings Plc generated a sum of N29.6 billion in the first six months of 2016.

According to Business247 News Online investigation, the above financial institutions recorded a growth of 106.33 per cent or N15.3 billion in six months of 2016 as against N14.4 billion generated in prior six months of 2015.

The GTBank announced N17.26 billion income generated through its electronic banking from N5.4 billion recorded in prior six months of 2015.

First Bank of Nigeria Holdings Plc’s E-banking related income stood at N10.35 billion in the first six months of 2016, 38 per cent above N7.5 billion generated in first six months of 2015.

Furthermore, Zenith Bank Plc generated N2 billion through its fees on electronic products in first six months of 2016 from N1.4 billion in prior six months of 2015.

Recall that the CBN in 2013 commenced phased reduction of CoT which terminated with zero CoT charge this year. But in a circular to banks early this year signed by Director, Financial Policy & Regulation Department, Mr. Kevin Amugo, the CBN replaced the CoT with CAT but subject to maximum of N1 per N1000 (mille).

The regulatory body policy’s on CoT has continued to erod banks fees and commission income, forcing banks to derived income generation through E-Banking income generation, Account services, maintenance and ancillary banking charges among others forms of fees and commission income generation.

The Managing Director/CEO, GTBank, Mr. Segun Agbaje recently said the bank has recorded tremendous growth rates in customer adoption of digital services. He said that GTBank would continue to be a bank of choice for digitally savvy customers.

He said, “Understanding that customers are always on the move; mobile banking puts us in the palm of our customers and provides a unique opportunity to offer quick and more efficient ways of providing banking services.

“Thus, we extended our mobile banking offering with the introduction of the 737 banking; a platform that allows customers transfer funds from, any bank in Nigeria, buy airtime, pay bills, link their BVN, and check account balances using their mobile devices.

“The 737 Banking platform provides us with an array of endless opportunities to partner with stakeholders, drive customers interactions and improve efficiency.”

Comments are closed.