The Central Bank of Nigeria (CBN) has said that non-performing loans (NPLs) in the banking sector rose by 78 per cent year-on-year to N649.63 billion at the end of May this year.

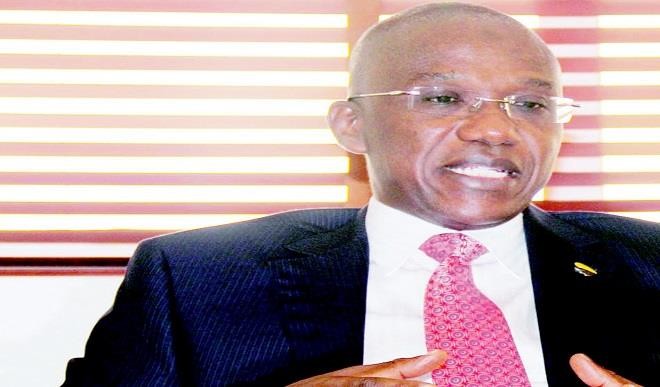

The Governor of CBN, Godwin Emefiele revealed this while speaking on Wednesday in Lagos at the third National Credit Reporting Conference organised by the Credit Bureau Association of Nigeria (CBAN).

He said that the current state of bad loans in the sector implies that efforts should be doubled in the area of credit information sharing in order to stem this worrisome trend.

According to him, the apex bank has made it mandatory for all financial institutions to have data exchange agreements with at least two credit bureaux.

He spoke further: “All banks are required to obtain credit report from at least two credit bureaux before granting any facility to their customers whilst quarterly portfolio checks must also be carried out to enable them determine borrowers’ current exposure to the financial system”.

The Governor who was represented by the Branch Controller at CBN Lagos Office, James Iyari, said the apex bank has also approved the payment of one-off sign on fees with credit bureaux for all the microfinance banks and other micro financial institutions licensed by the CBN.

He said this would support effective use of the infrastructure provided by the private credit bureaux with a view to deepening the subsector.

Emefiele also warned that bank customers that continuously issue dud cheques to their clients will have their cheque booklets withdrawn by their banks adding that lenders have the right to withdraw the cheque books from customers that record three defaults.

Comments are closed.