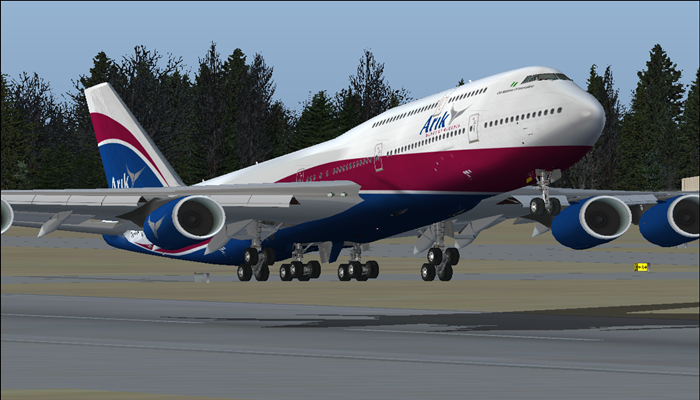

Arik Air, one of Nigeria’s leading airlines, plans to raise as much as $1 billion through a Private Placement next year and then a possible Initial Public Offering (IPO) in Lagos and London, its Managing Director told Reuters.

According to Reuters’ report monitored by Business247 News Online,the airline wants to expand internationally both to bring in more hard currency, as well as to cushion the impact of the economic slowdown at home, and wants new investors to help it grow rather than using internally generated cash or debt.

“What we plan to do is first a private placement which will bring in a few new shareholders, then one year or 18 months down the line we can do an initial public offer,” Chris Ndulue told Reuters in an interview.

He said Arik Air, which was founded a decade ago and is now west Africa’s biggest carrier by passenger numbers, had appointed advisers for the share placement and potential IPO in Lagos, with a secondary listing in London.

“We are looking at something in the neighbourhood of $1 billion for both private placement and IPO,” Ndulue said late on Wednesday.

The Lagos stock market, which is down 4 percent in local currency terms this year and at a 15-year low in dollar terms, has not had an IPO since 2009 due to sluggish appetite from foreign investors.

Ndulue said Arik wanted to start daily flights to New York, up from three times a week, and also fly to Rome and Paris within 18 to 24 months. The carrier, which has a fleet of 28 aircraft, flies mainly within western and central Africa, as well as to London and Johannesburg.

The new routes would help the company generate some foreign currency. Domestic and international carriers have struggled with the plunge in the naira that has made bills for imported jet fuel ever more expensive and also hurt profit margins as many passengers pay in naira.

“The biggest problem now is the foreign exchange issues. A lot of things are imported, a lot of services are imported we depend so much on foreign exchange which means that our costs have increased, in some cases more than doubled,” he said.

Emirates and Kenya Airways have announced plans to suspend flights to the Nigerian capital Abuja by next month due to falling demand as a currency crisis in Africa’s top economy deepens. United and Iberia both stopped services to Nigeria earlier this year.

Aderewa Ewatomi liked this on Facebook.

This is impressive hope to see the airlines back on the exchange official list.Also others like aero needs to look at the same direction.