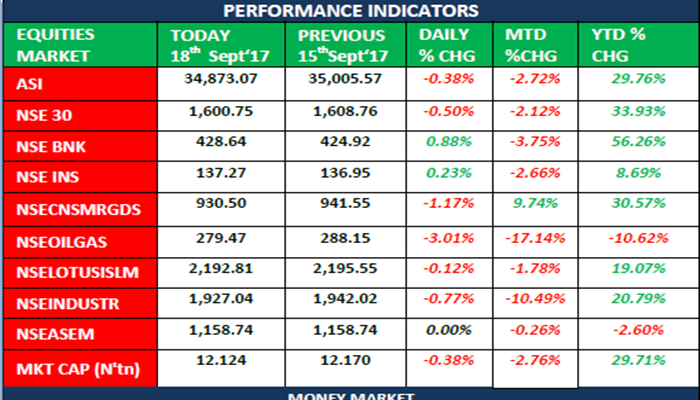

The equities market began the week downbeat. The bourse shed 38 basis points at the close of Monday’s trading session to drop the year-to-date (YTD) to 29.76 per cent and market capitalization also closed at N12.124 trillion. The Market breadth ratio stood at 0.78 with 14 gainers to 18 losers.

Market activities reclined today as volume traded closed marginally up by 1.62 per cent at 163 million from last week session of 160 million. Value declined by 47.99 per cent from N2.96 billion of previous levels to close at N1.54 billion today.

ACCESS, MEYER, FIDELITYBK, FBNH and FCMB topped the activities chart in terms of volume while ACCESS, ZENITHBANK, NB, WAPCO and GUARANTY topped the value’s chart to contribute majorly to today’s market worth.

NSEASI with all other sector indices swayed down into red zone save for NSEBNK & NSEINS as GUARANTY, SKYEBNK and STANBIC closed upbeat and bargain hunting favours NEM +2.52 per cent and LINKASSURE +1.69 per cent.

NSEOILGAS topped the sectoral losers chart as SEPLAT and OANDO fell by 5 per cent and 4.96 per cent respectively.

At the end of day’s trading session, NEIMETH topped the losers chart for three consecutive trading sessions with 8.43 per cent, 7.89 per cent and 8.57 per cent respectively while AIRSERVICE topped the gainers chart with 4.92 per cent today.

Today’s loss was triggered by negative price change in big cap stocks; Oil&Gas sector and Consumer Goods sector precisely as reflected by SEPLAT, OANDO and NB.

Analysts at APT Securities and Funds limited expect anticipation for third quarter result to bolster investors’ sentiment and hopefully fiscal actions from the Federal Government will enhance investors’ confidence as well but in the meantime, the market will continue to ride on cautious trading.