The All-Share Index and Market Capitalization of the Nigerian Stock Exchange (NSE) depreciated by 1.98 per cent and 2.09 per cent to close the week at 44,639.99 and N16.019 trillion respectively.

Similarly, all other indices finished higher during the week with the exception of the NSE-Main Board, NSE Consumer Goods and NSE Oil/Gas Indices that depreciated by 0.33 per cent, 3.33 per cent and 0.70 per cent respectively while the NSE ASeM Index closed flat.

Forty-nine (49) equities appreciated in price during the week, higher than thirty (30) of the previous week. Forty-two (42) equities depreciated in price, lower than forty-four (44) equities of the previous week, while eighty-one (81) equities remained unchanged lower than ninety-eight (98) equities recorded in the preceding week.

A total turnover of 3.268 billion shares worth N28.123 billion in 35,761 deals were traded this week by investors on the floor of the Exchange in contrast to a total of 7.157 billion shares valued at N42.545 billion that exchanged hands last week in 39,037 deals.

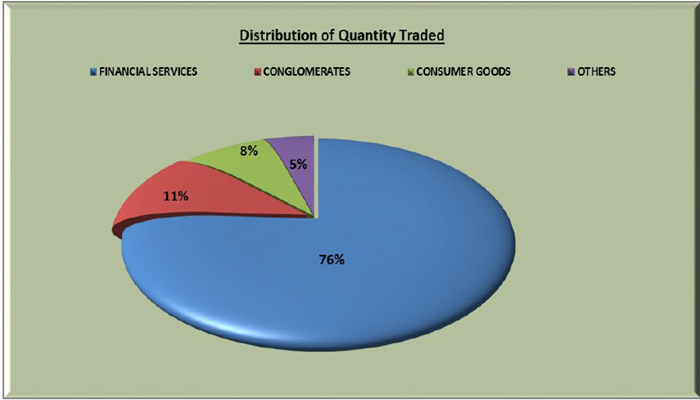

The Financial Services Industry (measured by volume) led the activity chart with 2.482 billion shares valued at N17.056 billion traded in 23,039 deals; thus contributing 75.96 per cent and 60.65 per cent to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 375.113 million shares worth N1.047 billion in 1,968 deals. The third place was occupied by Consumer Goods Industry with a turnover of 262.198 million shares worth N6.843 billion in 5,921 deals.

Trading in the top-three equities namely – FCMB Group Plc, Transnational Corporation of Nigeria Plc, and Skye Bank Plc (measured by volume) accounted for 1.181 billion shares worth N2.830 billion in 5,219 deals, contributing 36.14% and 10.06 per cent to the total equity turnover volume and value respectively.

Also traded during the week were a total of 32,189 units of Exchange Traded Products (ETPs) valued at N1.299 million executed in 19 deals, compared with a total of 153,755 units valued at N1.883 million that was transacted last week in 11 deals.

A total of 16,268 units of Federal Government Bonds valued at N17.053 million were traded this week in 28 deals, compared with a total of 6,715 units valued at N5.318 million transacted last week in15 deals.

An additional volume of 25,000,000 ordinary shares of 50 kobo each of Seplat Petroleum Development Company Plc were listed on The Daily Official List of The Exchange on the 1st of February, 2018. These additional shares were as a result of the company’s Long Term Incentive Plan (LTIP) for the benefit of it’s employees. With this listing, the company’s total issued and fully paid up shares now stands at 588,444,561 ordinary shares.

An additional volume of 45,122,840 units and 64,877,160 units were added to 14.50 per cent FGN JUL 2021 and 16.2884 per cent FGN MAR 2027 respectively on the 2nd of February, 2018.