Diamond Bank Plc has announced a profit before tax decreased from N3.4 billion in 2016 to a loss of N11.5billion during the year ended 2017.

The report and accounts filed to The Nigerian Stock Exchange (NSE) on Friday showed significant growth in gross earnings which rose by nine per cent year to year to N203.3 billion due to increase in interest income for the 2017 financial year.

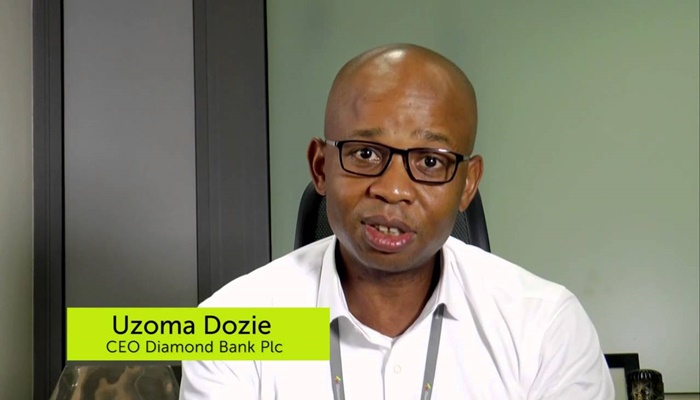

Commenting on the results, Chief Executive Officer, Uzoma Dozie said: Diamond Bank made good progress in executing its technology-led retail banking strategy in 2017. We increased our market share and drove scale through a combination of technology and expansion of our services across additional platforms. For instance, we made additional inroads to the unbanked and underbanked populations with the support of our international partners. In addition, the rapid rollout of products and services for entrepreneurs, and small and medium business owners gained significant traction and is a trend that is set to continue.

The Bank’s Net fees and commission were down by 1.3per cent year-on-year although impairment charges also trended downwards 0.3per cent year-on-year to N56.8 billion following continued efforts to improve the quality of the loan book, particularly in the Oil and Gas mid-stream sector. Operating costs of the Bank rose by 6.2per cent due to foreign exchange rate impact following the devaluation of the naira during the year.

“At a macro level, the economic environment improved, albeit marginally. Against this backdrop and Nigeria’s broader positive fundamentals, we disposed of some non-core assets to optimise the use of our resources and focus on the significant potential of our domestic market. By taking this action, Diamond Bank is better positioned to accelerate its growth, productivity and profitability in the short to medium term,” continued Uzoma.

The Bank recorded a decrease in profit before tax year-on-year because of higher operating expenses, although investments in technology are starting to drive operational efficiencies. Total asset increased by two per cent, which was mostly driven by marginal improvements recorded in customer deposits.

Diamond Bank reviewed ownership of non-core assets to focus on the significant opportunities in Nigeria, particularly in retail banking. This led to the divestment from Diamond Bank business in West Africa, with that in United Kingdom set to follow.

To restore its technology-led retail banking strategy, the Bank successfully delivered new initiatives, by building additional ecosystems and the expansion of customer services across different platforms. These include the DreamVille platform – the first Nigerian gamification portal for banking aimed at improving financial literacy and participation amongst youths.

“Although more work is to be done, particularly in relation to our oil and gas exposure, overall the quality of the loan book has improved. This will remain a key area of focus over the next 12 months. Looking ahead, I am optimistic that due to the actions we have taken as well as an improving economy, Diamond Bank will continue to make good progress and achieve greater profitability, concluded Uzoma’’

Observations on the floor of the Exchange, analysts and industry watchers opined that the Bank has been rightly positioned for accelerated growth in the next business years ahead, noting that with the strong retail strategy, digital infrastructure and focused management, the core fundamentals have continued to look up.