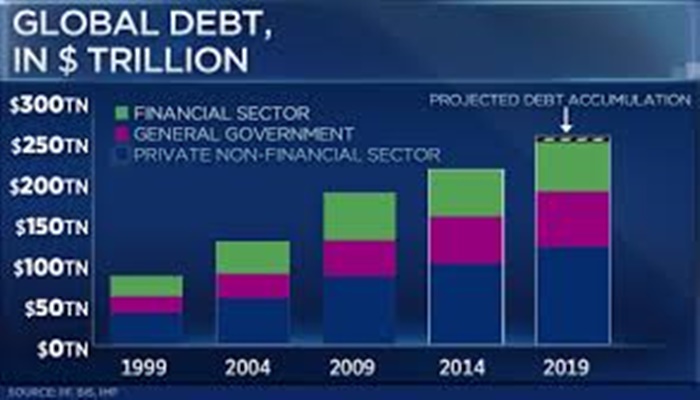

Global debt is on course to end 2019 at a record high of more than 255 trillion dollars, the Institute of International Finance (IIF) estimated on Friday — nearly 32,500 dollars for each of the 7.7 billion people on planet.

The amount, which is also more than three times the world’s annual economic output, has been driven by a 7.5 trillion dollars surge in the first half of the year that shows no signs of slowing.

Around 60 per cent of that jump came from the United States and China. Government debt alone is set to top 70 trillion dollars this year, as will overall debt (government, corporate and financial sector) of emerging-market countries.

“With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass 255 trillion dollars this year,” the IIF said in a report.

Across sectors, government debt saw the biggest rise in the first half of the year, increasing by 1.5 percentage points, followed by non-financial companies, with a 1 percentage point rise.

Moreover, with state-owned companies now accounting for over half of non-financial corporate debt in emerging markets, sovereign-related borrowing has been the single most important driver of global debt over the past decade.

Separate analysis from Bank of America Merrill Lynch on Friday calculated that since the collapse of U.S. investment bank Lehman Brothers, governments have borrowed 30 trillion dollars, companies have taken on 25 trillion dollars, households 9 trillion dollars and banks 2 trillion dollars.

The IIF’s data, which are based on Bank for International Settlements and International Monetary Fund figures as well as its own, also said the amount of debt outside the financial sector now topped 240 per cent of world gross domestic product at 190 trillion dollars.

Global bond markets have increased from 87 trillion dollars in 2009 to over 115 trillion dollars. Government bonds now make up 47 per cent of the market compared with 40 per cent in 2009. Bank bonds have dropped to below 40 per cent from over 50 per cent in 2009. (Reuters/NAN)