- All-Share Index and Market Capitalization depreciated by 0.54%

A turnover of 952.697 million shares worth N12.774 billion in 17,279 deals were traded last week by investors on the floor of the Nigerian Stock Exchange (NSE) in contrast to a total of 1.161 billion shares valued at N13.174 billion that exchanged hands last week in 18,142 deals.

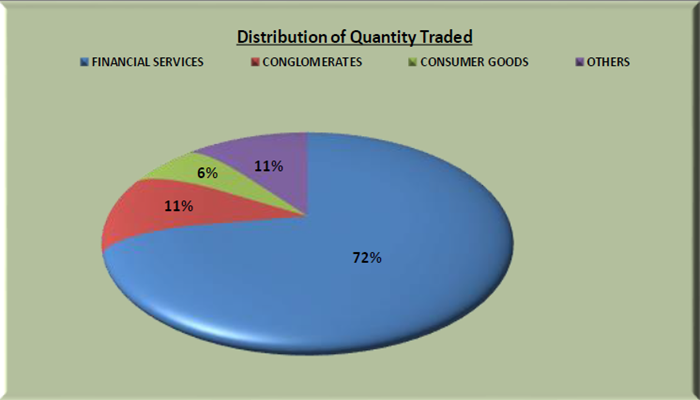

The Financial Services industry (measured by volume) led the activity chart with 690.986 million shares valued at N6.787 billion traded in 10,718 deals; thus contributing 72.53 per cent and 53.13 per cent to the total equity turnover volume and value respectively.

The Conglomerates industry followed with 101.908 million shares worth N701.283 million in 974 deals. The third place was Consumer Goods industry with a turnover of 57.636 million shares worth N2.009 billion in 2,095 deals.

Trading in the top-three equities namely, FCMB Group Plc, Access Bank Plc and Zenith Bank Plc. (measured by volume) accounted for 334.221 million shares worth N3.116 billion in 3,684 deals, contributing 35.08 per cent and 24.39 per cent to the total equity turnover volume and value respectively.

A total of 6,140 units valued at N103, 759.84 were traded this week in 17 deals, compared with a total of 11,991 units valued at N102, 312.34 transacted last week in 30 deals.

A total of 27,096 units of Federal Government Bonds valued at N27.630 million were traded this week in 25 deals, compared with a total of 313,912 units valued at N320.719 million transacted last week in 23 deals.

The NSE All-Share Index and Market Capitalization depreciated by 0.54 per cent to close the week at 26,855.52 and N12.962 trillion respectively.

All other indices finished lower with the exception of NSE Pension, NSE-AFR Div Yield, NSE Consumer Goods and NSE Lotus II indices which appreciated by 0.03 per cent, 1.54 per cent; 1.71 per cent and 0.97 per cent respectively, while the NSE ASeM Index closed flat.

Nineteen (19) equities appreciated in price during the week, lower than thirty-one (31) equities in the previous week. Thirty-five (35) equities depreciated in price, higher than thirty-two (32) equities in the previous week, while one hundred and eleven (111) equities remained unchanged, higher than one hundred and two (102) equities recorded in the preceding week.