When people are asked to determine the growth of a sector, it is easier to use revenue to measure the decrease or increase. Higher revenue is most times linked to growth but can that index alone be used them for Nigerian cinemas?

Nigeria already has a limited number of cinemas per one million people. In a country with over 190 million people, only a handful has embraced the cinema culture. In analyzing the growth of the cinema, only revenues of the existing theatres can be studied.

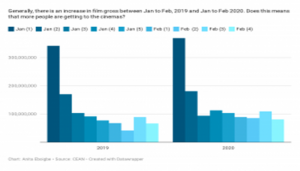

Data analysis of earnings clearly shows that, currently, Nigerian cinemas are in a trying phase. Analysis reveals that in comparison to the first two months of 2019, the first two months of 2020 had some gross increase.

However, in spite of the rise in revenue, data also show that fewer people visited the cinemas in January and February, 2020 when compared with 2019. Specifically, the cinemas had an average of 17.8 per cent growth in revenue.

In comparison with 2019, the first week of January, 2020 had an increase of 7.6 per cent; second week grew by 5.64 per cent before revenues hit a comparative decline by 9.93 per cent in the third week.

The growth maintained a steady nine per cent by the fourth week, eventually averaging 17.8 per cent when all the first nine weeks of 2019 and 2020 are placed side by side. Interestingly, the second and third weeks of February had the most surges, especially as there were more valentine-season films in 2020.

In a fascinating turn, 19,042 less admissions were recorded despite the noticeable surge in revenue. This number is equivalent to Nollywood’s biggest audience base on a good week. Numbers have shown that Nollywood records as low as 5,000 admissions and rarely hit over 12,000.

Still, the main trouble cinemas battle is the decline in admissions and what this means for the rest of the year. One might be tempted to ask if this is just seasonal and then assume that it might wear off as the year progresses. It would have been a perfect assumption if this was only a local problem.

Globally, cinemas are struggling against the moving wave of technology and fast content consumption. In spite of attempts to allay the fears of investors in the US and Canada, cinema revenue has remained stagnant in the last 10 years.

It is an international wind, blowing with so much force and fast changing the way people consume content. Nigeria has some hope. The content market is still underdeveloped and consumers are still green enough to prime.

It is no wonder then that international content stakeholders like Netflix are diving into the market at this time. Consumers are confused and need directing but there is no clear cut direction being given.

While the average Nigerian consumer is trying to get comfortable with visiting a cinema, especially to see a Nigerian film, most Nigerian producers are busy selling the films off quickly to streaming platforms. The films are not given enough time to simmer in the cinema nor are they different from what the audience would see in the cinema.

There is nothing wrong with selling off films to streaming platforms but the timing and quality should be such that two things are clear to the consumer. First, that the film has exhausted all possible theatre runs but is still in demand, hence the need for the streaming option.

Second, that the film is not exactly the same as those on the streaming platform. More so, it is a win-win for filmmakers – high cinema revenue and earnings from streaming rights.

In a small survey of 100 movie buffs done by News Agency of Nigeria (NAN), about 90 per cent of the respondent noted that they saw no point going to the cinema to see a film that will end up on streaming platform weeks later.

One of the respondents said, “Why should I go to see three Nollywood films in the cinema when the cost is enough for me to subscribe to a streaming platform and watch all the films there. They all end up there anyway.”

The survey also pointed to one of the reasons why Hollywood films take the lion share of Nigerian box office revenue. Consumers explained that once they missed the theatre window for seeing a foreign film, they regret it because it takes a long time to find it elsewhere.

This is on the assumption that piracy is not an option plus they admitted that it was not the same as watching on the screen. That is, “watching a pirated Hollywood film is not exactly the same as seeing it in the cinemas.”

Already, in the US, experts are asking theatre owners to put themselves in the shoes of consumers. They are overwhelmed by choices and need good businesses to make their decision-making process easier.

Thales Teixeira, Harvard Business School professor turned consultant, tasked theatre owners to blame their customers. If your customers are happy with your product or service, it would be harder to lose them.

Therefore, it goes without saying that with the new entrance of Netflix and others trailing behind them, the fight for consumers has officially kicked off. 19,000 admissions dip might seem little but each month nothing is done, the number triples until every consumer sits at home waiting for the next Netflix Nollywood original week in, week out.

No matter the lens it is taken with, this future does not seem like a pretty picture. The tiny revenue surge experienced in 2020 is as a result of increased ticket prices in some quarters from the base it was in 2019. If the price is increased more, consumers will eventually count their losses and rely solely on streaming services.

Like earlier stated, there is hope and room for all stakeholders in the film business to win. A mutual agreement where cinema movies and theater runs are sorted to not conflict with streaming in order to retain customers on both ends can work.

Netflix already has co-opted the cinema leaders in Nollywood and they are currently busy producing for the platform, leaving a gaping hole that will come around to hurt the cinemas. Still, careful planning, symbiosis and alignment of priorities are a good place to start. (NAN)