The Nigerian Stock Exchange (NSE) All-Share Index and Market Capitalization both depreciated by 3.51 per cent to close the week at 21,094.62 and N10.994 trillion respectively.

All other indices finished lower with the exception of NSE Oil/Gas which appreciated by 2.33% while NSE ASeM Index closed flat.

In all, 15 equities appreciated in price during the week, lower than 34 in the previous week with 36 equities depreciated in price, higher than 30 equities in the previous week, while 112 equities remained unchanged, higher than 99) equities recorded in the preceding week.

Meanwhile, a total turnover of 1.534 billion shares worth N11.267 billion in 18,928 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 1.452 billion shares valued at N14.918 billion that exchanged hands last week in 21,828 deals.

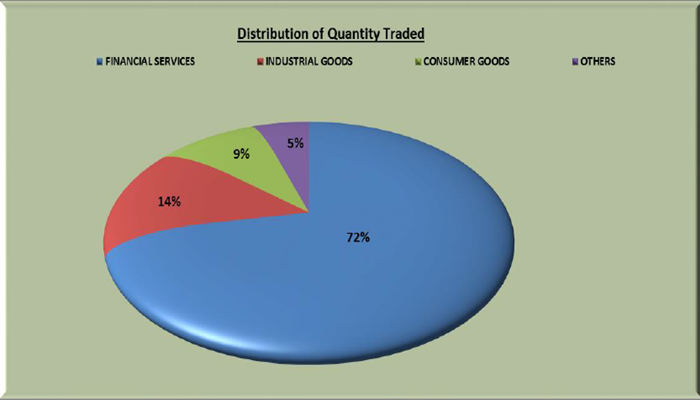

The Financial Services industry (measured by volume) led the activity chart with 1.105 billion shares valued at N7.100 billion traded in 12,225 deals; thus contributing 71.99% and 63.02% to the total equity turnover volume and value respectively.

The Industrial Goods followed with 218.471 million shares worth N1.236 billion in 1,610 deals. The third place was the Consumer Goods industry, with a turnover of 134.599 million shares worth N1.855 billion in 2,332 deals.

Trading in the Top Three Equities namely, Sterling Bank Plc, Zenith Bank Plc and Meyer Plc. (measured by volume) accounted for 752.359 million shares worth N3.247 billion in 4,039 deals, contributing 49.03% and 28.82% to the total equity turnover volume and value respectively.

A total of 6,759 units valued at N61,035.98 were traded this week in 19 deals, compared with a total of 20 units valued at N130.90 transacted last week in 2 deals.

A total of 10,100 units of Federal Government Bonds valued at N11.145 million were traded this week in 2 deals, compared with a total of 28,527 units valued at N29.950 million transacted last week in 18 deals.