The Nigerian Stock Exchange (NSE) All-Share Index and Market Capitalization both appreciated by 12.97 per cent to close last week at 35,037.46 and N18.308 trillion respectively. Similarly, all other indices finished higher while the NSE ASeM Index closed flat.

A total 69 equities appreciated in price during the week, higher than 40 in the previous week even as 12 equities depreciated in price, lower than 24 in the previous week, while 80 remained unchanged, lower than 97 recorded in the previous week.

It was a historic trading week as the NSE All-Share Index (ASI) posted its largest daily gain in more than five years on Thursday, 12 November 2020. The ASI rose beyond the set threshold of 5 per cent triggering a 30-minute trading halt of all stocks for the first time since the Circuit Breaker was introduced in 2016.

The Circuit Breaker protocol was triggered at 12:55p.m., when the NSE ASI increased from 33,268.36 to 34,959.39. The market reopened at exactly 1:25p.m., with a 10-minute intra-day auction session before resuming continuous trading till the close of the day at 2:30p.m.

Meanwhile, a total turnover of 4.509 billion shares worth N58.733 billion in 47,140 deals were traded last week by investors on the floor of the Exchange, in contrast to a total of 2.067 billion shares valued at N22.636 billion that exchanged hands last week in 25,187 deals.

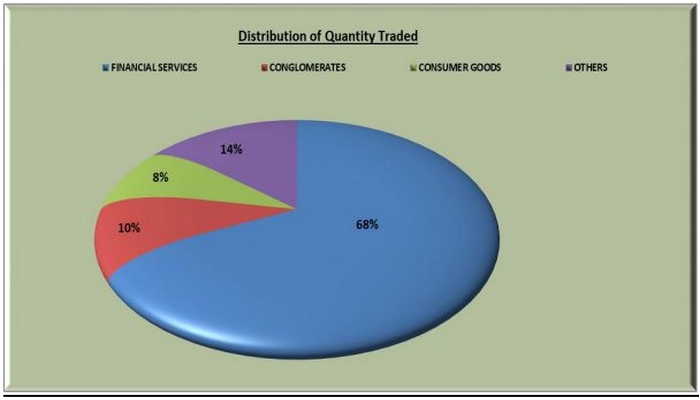

The Financial Services industry (measured by volume) led the activity chart with 3.073 billion shares valued at N35.408 billion traded in 25,894 deals; thus contributing 68.15% and 60.29% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 437.822 million shares worth N771.280 million in 1,864 deals. The third place was the Consumer Goods Industry, with a turnover of 373.613 million shares worth N7.816 billion in 7,471 deals.

Trading in the top three equities namely Zenith Bank Plc, FBN Holding Plc and Transcorp Hotels Plc (measured by volume) accounted for 1.426 billion shares worth N18.083 billion in 9,537 deals, contributing 31.63% and 30.79% to the total equity turnover volume and value respectively.

A total of 986,941 units of ETPs valued at N4.685 billion were traded this week in 62 deals compared with a total of 238,441 units valued at N2.054 billion transacted last week in 8 deals.

Also, a total of 13,332 units Bonds valued at N17.142 million were traded last week in 19 deals compared with a total of 6,011 units valued at N7.543 million transacted last week in 14 deals.