NSE market indicators rebound by 0.17%

The All-Share Index rose by 69.01 points or 0.17 per cent to close at 40,465.15 from 40,396.14 recorded on Tuesday.

Also, the market capitalisation which opened at N21.122 trillion inched higher by N36 billion or 0.17 per cent to close at N21.158 trillion.

The uptrend was driven by price appreciation in medium and large capitalised stocks, amongst which are Zenith Bank and United Bank for Africa.

Others include BOC Gases, Flour Mills and Vitafoam Nigeria.

Market breadth was positive with 23 gainers against 16 losers.

NEM Insurance led the gainers’ chart in percentage terms, growing by 9.69 per cent to close at N2.15 per share.

BOC Gases followed with 9.52 per cent to close at N11.50, while Japaul Gold rose by 9.46 per cent to close at 81k per share.

Linkage Assurance grew by 9.26 per cent to close at 59k, while Regency Alliance Insurance appreciated by 9.09 per cent to close at 24k per share.

On the other hand, Sovereign Trust Insurance dominated the losers’ chart in percentage terms by 8.33 per cent to close at 22k per share.

Eterna followed with a loss of 8.17 per cent to close at N5.28 per share.

Deap Capital Management & Trust shed eight per cent to close at 23k, while Royal Exchange and FTN Cocoa Processors depreciated by 7.69 per cent each to close at 24k and 60k per share, respectively.

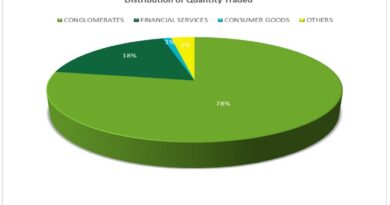

However, the total volume traded declined by 46.41 per cent as investors bought and sold 249.55 million shares worth N2.18 billion in 6,090 deals.

This was against a total of 465.67 million shares valued at N5.12 billion exchanged in 7,573 deals on Tuesday.

Transactions in the shares of Japaul Gold and Ventures topped the activity chart with 28.05 million shares worth N22.72 million.

Access Bank followed with 21.89 million shares valued at N190.43 million, while AXA Mansard Insurance sold 13.26 million shares worth N16.39 million.

United Bank for Africa accounted for 13.23 million shares valued at N113.09 million, while Transcorp transacted 12.79 million shares worth N12.13 million. (NAN)