A total turnover of 4.288 billion shares worth N25.989 billion in 32,849 deals were traded this week by investors on the Exchange Stock Exchange (NSE), in contrast to a total of 3.447 billion shares valued at N32.725 billion that exchanged hands last week in 30,327 deals.

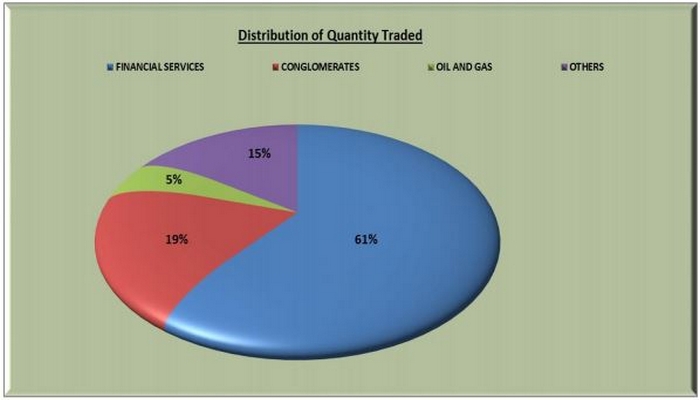

The Financial Services Industry (measured by volume) led the activity chart with 2.607 billion shares valued at N12.454 billion traded in 15,128 deals; thus contributing 60.81 per cent and 47.92 per cent to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 813.813 million shares worth N1.561 billion in 2,417 deals, while the third place was Oil and Gas Industry, with a turnover of 212.126 million shares worth N821.978 million in 2,726 deals.

Trading in the top-three equities namely Transnational Corporation of Nigeria, Living Trust Mortgage Bank Plc and Japaul Gold and Ventures Plc (measured by volume) accounted for 1.582 billion shares worth N1.564 billion in 2,726 deals, contributing 36.9% and 6.02 per cent to the total equity turnover volume and value respectively.

A total of 778,755 units of ETPs valued at N4.575 billion were traded this week in 46 deals compared with a total of 413,509 units valued at N2.454 billion transacted last week in 42 deals.

In the Bonds market, a total of 2,515 units valued at N2.606 million were traded this week in 16 deals compared with a total of 11,420 units valued at N12.325 million transacted last week in 17 deals.

The NSE All-Share Index and Market Capitalization depreciated by 0.42 per cent and 0.38 per cent to close the week at 41,001.99 and N21.449 trillion respectively.

Similarly, all other indices finished lower with the exception of NSE MERI Growth which appreciated by 0.12 per cent while the NSE ASeM and NSE Growth Indices closed flat.

A total of 53 equities appreciated in price during the week, lower than 60 in the previous week even as 29 equities depreciated in price, higher than 19 in the previous week, while 79 remained unchanged, lower than 82 recorded in the previous week.

A total volume of 4,890,000, 5 Years 5.5% Series 4 (Tranche A) Fixed Rate Senior Unsecured Bond Due 2025 under the N70,000,000,000 Bond Issuance Program; and the 25,000,000, 7 Years 6.25% Series 4 (Tranche B) Fixed Rate Senior Unsecured Bond Due 2027 Under the N70,000,000,000 Bond Issuance Program of Flour Mills of Nigeria Plc were listed by memorandum on Thursday 21st January, 2021.

Also, Transcorp Hotel Plc listed additional shares (Rights Issue) of 2,642,124,511 Ordinary Shares of 50 Kobo Each at N3.76 Kobo Per Share) on the Daily Official List of The Nigerian Stock Exchange (The Exchange) on Monday, 18 January 2021.

The additional shares listed on The Exchange arose from the Company’s Rights Issue of 2,659,574,468 Ordinary Shares of 50 kobo each at N3.76 Kobo per share on the basis of seven (7) new Ordinary Shares for every twenty (20) Ordinary Shares held as at Monday, 13 July 2020.

The Rights Issue was 99.34 per cent subscribed. With this listing of the additional 2,642,124,511 Ordinary Shares, the total issued and fully paid-up shares of Transcorp Hotel Plc has now increased from 7,600,403,900 to 10,242,528,411 ordinary shares of 50 kobo each.