The All-Share Index of Nigerian Exchange Limited surged by 5.32 percent at the end of trading on Tuesday.

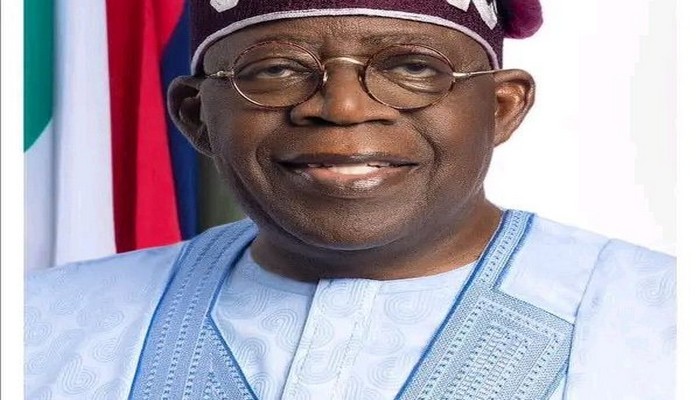

The Exchange in a press statement on Tuesday attributed the development to the removal of subsidy by the newly inaugurated president of Nigeria, Bola Ahmed Tinubu.

Market capitalisation of stocks on the Exchange jumped to N30.35 trillion as investors exchanged 1.08 billion shares valued at N15.8 billion in 9,916 deals, a 133.4% rise from the previous trading day’s tally of 461.78 million shares worth N7.68 billion in 6,520 deals.

This was just as sovereign dollar-denominated bonds rallied on the announcement of both subsidy removal and the harmonisation of the exchange rates on the investors and exporters window (NAFEX) and the parallel markets. Nigeria’s foreign reserves have long been pressured by the loss of forex earnings due to low oil production levels and the use of scarce dollars to defend the official value of the Naira.

According to industry experts and multilateral lenders like the International Monetary Fund (IMF), the harmonisation of the rates and removal of subsidy will improve the attraction of the Nigerian economy to foreign investors and also help the government channel useful funds into more productive ventures like infrastructural investment, education and healthcare.

The top five gainers on Monday were Deap Capital Plc, Eterna Plc, FCMB Group Plc, Nigerian Brweries Plc and Zenith Bank Plc which all saw gains of 10% each. The major decliners were Ikeja Hotel Plc (-10%), NCR (-9.8%), Tantalizers Plc (-8%), International Energy Insurance Plc (-6.98%) and Consolidated Hallmark Insurance Plc (-6.56%).