Dangote Cement: Exploring Africa to improve profitability, dividend

Dangote Cement Plc declared an impressive performance in profitability that leveraged on its dividend payout, the highest dividend payout to shareholders by listed cement manufacturing company.

The improved performance was based on significant growth in revenue and assets quality as the cement manufacturing company total assets crossed the N1 trillion threshold.

The group continued to strengthen its business network across Africa (South Africa, Ethiopia, Tanzania, Congo, Cameroon, Senegal, Zambia, Ghana) with Nigeria leading the business frontline.

Also, Dangote Cement combined appreciable growth in non-core business transactions with efficient cost management deliver its most impressive in recent year results.

Audited report and accounts of Dangote cement for the financial year ended December 31, 2015 showed significant increase in revenue, finance income that underlined 14 per cent growth in profit after tax

As the group expends its business across Africa, its total assets improved by nearly 13 per cent, alongside increase in equity funds due to improved retained earnings that gained 15.4 per cent to N620 billion

From the financial statement, Dangote Cement balance sheet emerged stronger with better financial structure and improved liquidity.

The share price of Dangote Cement on the Nigerian Stock Exchange closed on March 19, 2016 at N161.00.

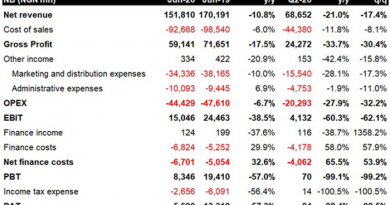

Improved revenue that impacted profits

Dangote Cement recorded appreciable improvements in both underlying and actual profit and loss items. Substantial growths in revenue and profits translated into significant increase in basic earnings per share.

Group revenue rose by nearly 26 per cent from N391.6billion in 2014 to N491.7 billion in 2015.

The breakdown of Dangote Cement in 2015 indicated that its revenue from sales of cement moved from N391.27 billion in 2014 to N491.5 billion in 2015 while revenue from sales of other product stood at N181 million in 2015 as against N369 million recorded in 2014.

Dangote cement increased its production capacity in the year under review by 89 per cent to 42.5 million metric tonnes as against 22.7 million metric tonnes recorded in 2014.

Production cost of sales (COS) increased by 41.1 per cent from N143 billion in 2014 to N201.8 billion in 2015, to accelerate 16.6 per cent increase in gross profit from N248.58 billion in 2014 to N289.9 billion in 2015.

Therefore, the proportion of revenue/COS stood at 41 per cent in 2015 compared with 36.5 per cent in 2014.

Total operating expenses however rose by 32.2 per cent from N65 billion to N86 billion.

The breakdown of total operating expenses indicated that selling and administrative expenses rose by 30 per cent from N41 billion to N53.5 billion while administrative expenses gained 35 per cent to N32.5 billion as against N24.1 billion in 2014.

Consequently, total operating expenses/revenue gained 17.5 per cent in 2015 as against 16.6 per cent in 2014.

It is very important to note that Dangote cement finance income significantly moved from N30.5 billion to N34.8 billion.

Finance cost leapt high by 65 per cent from N32.98 billion in 2014 to N54 billion in 2015. Dangote cement remarkably show its interest expenses gaining 53 per cent from N22 billion to 33.8 billion while foreign exchange loss moved from N14.5 billion to N20.87 billion recorded in 2015.

For the year under consideration, Dangote Cement profit before tax rose by two per cent from N184.7 billion in 2014 to N188.3 billion in 2015.

With about 73.2 per cent decline in tax income from N25.2 billion to N6.97 billion, profit after tax increased by 14 per cent from N159.5 billion in 2014 to N181.29 billion in 2015.

Earnings per share stood at N10.86 in 2015, representing an increase of 15.3 per cent on N9.42 recorded in 2014.

Profitability indices remained stronger in 12-month ended December 2015. Profit margin moved from 47.2per cent to 38.3per cent while return on equity improved from 26.9 per cent to 28.1per cent.

Return on total assets stood at 16.9 per cent in 2015 as against 18.8 per cent in 2014.

Stronger financing structure in assets, equity

Dangote Cement’s total assets increased by 12.8per cent from N984.7 billion as at December 2014 to N1.11 trillion as at December 2015.

Long-term assets increased by about 11.5 per cent from N847.6 billion to N944.96 billion while current assets rose by 21.1 per cent to N165.98 billion as against N137billion as at December 2014.

Total liabilities also gained 18.7 per cent to N466 billion as at December 2015 compared with N392.5 billion as at December 2014.

Current liabilities closed 2015 at N200.6 billion from N232.9 billion while long-term liabilities moved from N159.9 billion to N265.5 billion in 2015.

Retained earnings rose by 15.3 per cent to N620.5 billion in 2015 while shareholders’ funds grew by nine per cent to N644.7 billion as at December 2015 from N591.9 billion the prior year.

Meanwhile, the proportion of equity funds to total assets dropped from 58 per cent to 60.1 per cent. The proportion of total liabilities amounted to 42 per cent of total balance sheet size in 12-month as against about 39.9 per cent as at December 2014.

Maintaining a stronger liquidity

Dangote Cement emerged with stronger liquidity. Current ratio, which measures the financial agility of a company by relating current assets to relative liabilities, improved from 0.60 times in 2014 to 0.8 times in 2015.

Points to note

Despite the macro economy headwinds in the year, Dangote Cement has proposed a dividend of N8.00. Market analysts lauded consistent dividend payment to shareholders by the management of Dangote cement.

The cement industry before now had suffered a setback due to economic instability from fiscal revenue shortfall and heightened political activities which re-channelled liquidity from the productive activities to electioneering spending.

With a peaceful transition in government, it tends to provide huge opportunity for cement companies with Dangote Cement positioned as market leader.

Business247 is optimistic about the company’s improved revenue and potential growth in shareholders return going forward as President Buhari 2016 budget is focused on Infrastructure spending that is expected to revive economic growth.

Following an expansion exercise that has seen it embarking on a pan African investment drive, Dangote Cement is planning a production target of at least 54 million metric tonnes by the end of 2017.

Under the strategic plan, the company hopes to consolidate its growth and expansion in the 13 countries where it has operational capacity while exploring measures to improve cost efficiency and profitability.

Through its recent investments, Dangote Cement has eliminated the country’s dependence on imported cement and is transforming the nation into an exporter serving neighbouring countries.

The company is a fully integrated cement company and has projects and operations in Nigeria and 14 other African countries; Dangote Cement’s current total production capacity in Nigeria from its three existing cement plants namely Obajana (10.25 million metric tonnes per annum), Ibese (6.0 million metric tonnes per annum) and Gboko (4.0 million metric tonnes per annum) is 20.25 million metric tonnes per annum.

The Obajana Cement Plant located in Kogi State is reputed to be one of the single largest cement plants in the world with a combined capacity of 10.25 million metric tonnes per annum.

Fourth lines which add three million metric tonnes per annum to the existing capacity will bring the total capacity of Obajana to 13.25 million metric tonnes per annum by 2015.