By Saka Olalekan

As the country battles financial deficit as a result of dwindling revenue source from oil, the Pension Fund Administrators (PFAs) across the country said they were ready to assist the Federal Government to finance its infrastructural projects through the N5.3 trillion pension assets, urging FG to develop attractive infrastructure bonds that will guarantee the fund.

The operators, who spoke at a seminar organised by Pension Fund Operators of Nigeria (PenOp) for Pension correspondents in Lagos, noted that pension operators are not running away from financing infrastructure, stating that there is currently, no single infrastructure bond in the country.

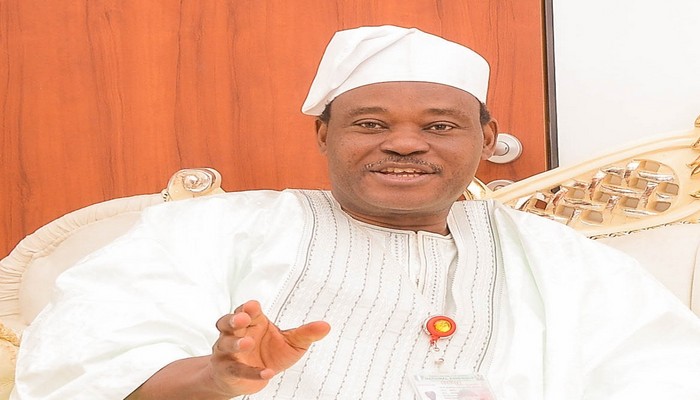

Speaking on behalf of operators, the Chairman, Pension Funds Operators of Nigeria (PenOp), Mr. Eguarekhide Longe, said its members are ready to invest in infrastructural bonds whenever the government decides to float them to finance key developmental projects.

Promising that the pension fund managers are ready to engage with government to expand the economic space, even though, it is not their primary objective, he added that, care must be taken not to invest pension fund in a project that will not regenerate it, saying, ‘if you put pension fund in a project that does not regenerate it, the money is gone and in many cases, as we have found, the project has not been delivered because it was not properly conceived.’

While debunking claims that PFAs don’t want to invest pension assets in infrastructure, he said the managers had requested the investment banking community to come out with products that abide by the investment guidelines in Pension Act, which operators can finance, noting that this has not been done.

“The fact is that there are ample provisions in the investment guidelines that allows for investment in projects, so to say, infrastructure, private equities and real estates, bonds, among others. But what has happened is not that the money is idle in the PFAs or that the fund managers have not looked for those projects. It is not their jobs to go and create projects, but we have actively sort the investment banking community to develop products that we can invest in,” he pointed out.

Earlier, Head, Investments, Pensions Alliance Limited (PAL), Mrs. Abimbola Sulaiman, said lack of investment options, bankable projects, transparency; shortage of data as well as high risk related greenfield investment among others, are challenges limiting investment of pension funds especially in infrastructure.

In a paper entitled: “Investment of Pensions Funds, Processes- Challenges, Risks and Rewards”, she suggested some consideration and review of existing engagement rule to create opportunities for investment in critical areas in the economy, adding that infrastructure bonds remain the easiest way to introduce majority of pension funds into infrastructure investments, as it is similar to traditional bond investments.

Sulaiman opined that when considered that an estimated $3 trillion is required over a period of 30 years to cover infrastructure deficit according to the National Integrated Infrastructure, the limit of spending is grossly inadequate.

She said government should consider the introduction of infrastructure bond as the surest way to introduce majority of pension funds with infrastructure investment.

Bonds, she said, should be tied to specific projects issued with government guarantees and issued at project completion or close to cash flow generation.

Listing challenges attribute to investment of pension fund in government infrastructure; Sulaiman said there is regulatory instability, inadequate viable Public Private sector Partnership, legal framework, high bidding and fragmentation of market amongst different levels of government.

Comments are closed.