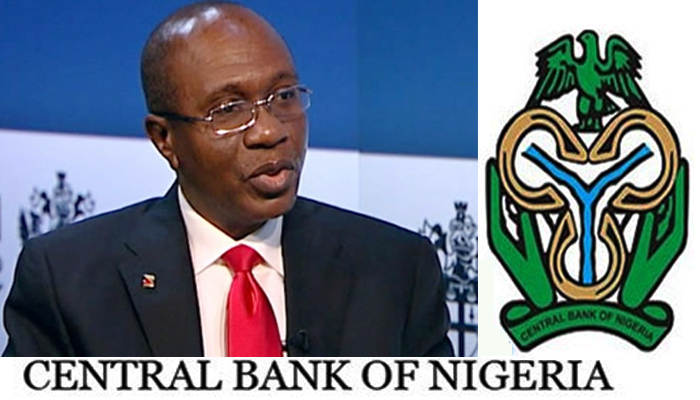

CBN retains key lending rate at 14%

The Central Bank of Nigeria (CBN) on Tuesday said it has retained the Monetary Policy Rate (MPR) at 14 per cent with +/- 200 and 500 asymmetric corridor.

The CBN Governor, Mr. Godwin Emefiele, who disclosed this on Tuesday at the end of 2017’s first Monetary Policy Committee (MPC) meeting in Abuja said that the Cash Reserve and the Liquidity Ratios were also retained at 22.5 per cent and 30 per cent, respectively.

Emefiele also disclosed that the nation’s foreign reserve has reached $28.9 billion, but that the nation could still not afford to be reckless with the management of its foreign exchange.

He explained the reason behind laving the rate as they were, he said: “Conscious of the prevailing market sentiments in favour of a rate cut, the Committee reasoned that most of its decisions in 2016 were informed by the need to address the delicate balance between price stability and growth.

“Noting that the pressures on consumer prices were yet to abate and even as the economy continued to be in recession despite the intervention support by the Central Bank, the Committee stressed that it was not oblivious of the full ramifications of the economic challenges facing the country.

“The MPC was concerned that the current situation was not amenable to simplistic analyses and quick fixes such as have found expression and increased attention at different fora and the media.

“The domestic economic challenges which include a chronically import dependent consumption culture, lack of competitiveness of many sectors of the economy and yawning infrastructural gap, have combined with an unfavorable external environment to complicate the macroeconomic policy environment.

“The Monetary Authority had on many occasions, and to the extent feasible, taken extra-ordinary steps to support other policies as well as compensate for aspects of structural gaps in the economy even at the expense of its core mandate.”