Market down 0.92% as investors stake N6.04bn

A turnover of 1.191 billion shares worth N6.037 billion in 11,820 deals were traded this week by investors on the floor of the Nigeria Stock Exchange (NSE) in contrast to a total of 786.176 million shares valued at N5.828 billion that exchanged hands last week in 14,343 deals.

The NSE All-Share Index and Market Capitalization depreciated by 0.92 per cent to close the week at 25,510.01 and N8.827 trillion respectively. Similarly, all other Indices finished lower during the week with the exception the NSE ASeM Index that closed flat.

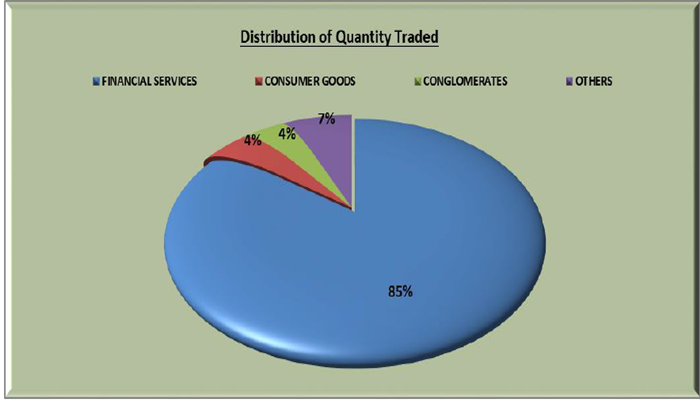

The Financial Services Industry (measured by volume) led the activity chart with 1.014 billion shares valued at N3.070 billion traded in 6,700 deals; thus contributing 85.07 per cent and 50.86 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 51.888 million shares worth N1.581 billion in 2,025 deals. The third place was occupied by Conglomerates Industry with a turnover of 47.517 million shares worth N66.904 million in 542 deals.

Trading in the Top Three Equities namely – Fidelity Bank Plc, FCMB Group Plc and Standard Trust Assurance Plc (measured by volume) accounted for 679.949 million shares worth N639.862 million in 1,622 deals, contributing 57.06% and 10.60% to the total equity turnover volume and value respectively.

Also traded during the week were a total of 16 units of Exchange Traded Products (ETPs) valued at N1,088.00 executed in 1 deal compared with a total of 1,510 units valued at N4,113.20 transacted last week in 3 deals.

A total of 4,800 units of Federal Government Bonds valued at N4.892million were traded this week in 10 deals, compared with a total of 11,064 units valued at N10.256million transacted last week in 21 deals.

Thirteen (13) equities appreciated in price during the week, lower than thirty-six (36) equities of the previous week. Thirty-seven (37) equities depreciated in price, higher than twenty-two (22) equities of the previous week, while one hundred and twenty-seven (127) equities remained unchanged higher than one hundred and nineteen (119) equities recorded in the preceding week.