Investors stake N16.40bn on Nigerian bourse last week

A total turnover of 1.394 billion shares worth N16.403 billion in 19,195 deals were traded last week by investors on the floor of the Nigerian Stock Exchange (NSE) in contrast to a total of 872.892 million shares valued at N14.016 billion that exchanged hands last week in 19,047 deals.

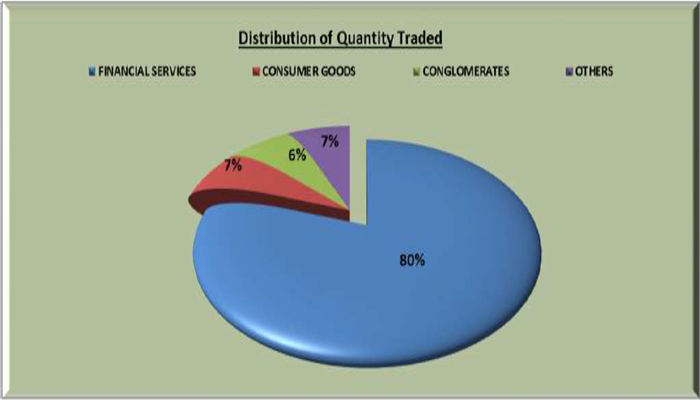

The Financial Services Industry (measured by volume) led the activity chart with 1.116 billion shares valued at N10.153 billion traded in 9,942 deals; thus contributing 80.05 per and 61.90 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 95.005 million shares worth N3.251 billion in 4,443 deals. The third place was occupied by Conglomerates Industry with a turnover of 90.194 million shares worth N645.159 million in 1,136 deals.

Trading in the top-three equities namely – United Bank for Africa Plc, Access Bank Plc and FBN Holdings Plc (measured by volume) accounted for 515.058 million shares worth N4.458 billion in 3,088 deals, contributing 36.95 per cent and 27.17 per cent to the total equity turnover volume and value respectively.

Also traded during the week were a total of 104,544 units of Exchange Traded Products (ETPs) valued at N11.506 million executed in 7 deals compared with a total of 34,573 units valued at N2.091million transacted last week in 14 deals.

A total of 559 units of Federal Government Bonds valued at N485,802.83 were traded this week in 5 deals, compared with a total of 7,279 units valued at N7.139 billion transacted last week in 12 deals.

The NSE All-Share Index depreciated by 0.34 per cent while the Market Capitalization appreciated by 0.20 to close the week at 36,462.26 and N12.619 trillion respectively.

In addition, all other Indices finished lower during the week with the exception of the NSE ASeM, NSE Banking, NSE Lotus II and NSE Pension Indices that appreciated by 0.18 per cent,0.84 per cent, 0.57 per cent and 0.76 per cent respectively.

Thirty-three (33) equities appreciated in price during the week, higher than twenty-three (23) of the previous week. Thirty-two (32) equities depreciated in price, lower than thirty-four (34) equities of the previous week, while one hundred and six (106) equities remained unchanged lower than one hundred and fourteen (114) equities recorded in the preceding week.