Negative trend persists on NSE as Index down 1.42%

The Nigerian equities market closed negative for the third consecutive session on Thursday, with the benchmark index dropping 1.42 per cent to 32,006 points, as profit taking in value stocks persisted.

As a result, the Year-to-Date loss increased to 16.31 per cent as all sectoral indices closed in the red, with the Industrial Goods (-2.10%) index remaining the top loser, followed by the Consumer Goods (-1.13%), Oil & Gas (-0.79%), Banking (-0.61%), and Insurance (-0.07%) indices.

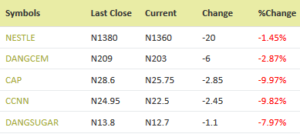

Notable stocks include DANGCEM (-2.87%), CADBURY (-10.00%), ETERNA (-9.92%), DIAMONDBNK (-7.09%, and AFRIPRUD (-9.82%) respectively.

Market breadth remained negative with 24 losers and 11 gainers, led by CADBURY (-10.00%) and JAPAULOIL (+10.00%) shares respectively. Total volume and value of trades rose by 67.41% and 29.02% to 355.76 million units, valued at NGN4.86 billion, and exchanged in 3,019 deals.

“We reiterate our negative outlook for the equities market in the short-to-medium term, amidst political concerns in the 2019 elections, and absence of a positive market trigger. However, positive macroeconomic fundamentals remain supportive of recovery in the long term”. Analysts at Cordros Capital said.

The USD/NGN closed flat in both the parallel market and I&E FX window at NGN362 and NGN363.54, respectively. Total turnover in the IEW dropped 11.58% to USD397.57 million, with trades consummated within the NGN358.00-364.50/USD band. It is worth stating that the foreign reserves, according to most recent data from the CBN, dropped below the USD42 billion mark, for the first time since February, to USD41.995 billion.

Also, the overnight lending rate was flat at 4.92% amidst still buoyant liquidity. The CBN mopped up today’s inflow of OMO bills (NGN397.24 billion) via OMO auction, selling a total of NGN517.62 billion — NGN84 million of the 91DTM, NGN62.80 billion of the 182DTM and NGN453.98 billion of the 350DTM — worth of bills, at respective stop rates of 11.50%, 13.00% and 14.50%.

Sentiments in the NTB market were bullish, as average yield compressed by 11 bps to 13.70%. Demand for the 21DTM (-118 bps), and 168DTM (-27 bps) bills, led to yield contraction at the short (-33 bps) and mid (-4 bps) segments. Conversely, yield at the long (+18 bps) end of the curve expanded, driven by a selloff of the 350DTM (+81 bps) bill.

Proceedings in the bond market were bearish, as yields expanded by 6 bps, on average, to 15.28%. There were selloffs across the short (+4 bps), mid (+3 bps), and long (+14 bps) segments, with the FEB-2020 (+24 bps), FEB-2028 (+9 bps), and MAR-2036 (+17 bps) bonds recording the largest contractions