NSE announces its Sustainability Disclosure Guidelines (SDG)

- Reporting becomes effective January 1, 2019

- Joins 39 SSEI members with ESG reporting Guidance

In fulfilment of its desire to champion sustainable capital market practices in Africa, The Nigerian Stock Exchange has announced that its Sustainability Disclosure Guidelines has been approved by The Securities Exchange Commission (SEC).

The Exchange recognizes that the promotion of Environmental, Social and Governance (ESG) principles can facilitate more meaningful engagement between investors and listed companies on ESG risks and opportunities. This, in turn, is expected to further deepen the role played by market operators and regulators in leading sustainability policies and regulations.

The guidelines, according to The Exchange in a press statement on Wednesday, primarily provide the value proposition for sustainability in the Nigerian context. It also articulates a step by step approach to integrating sustainability into organisations, indicators that should be considered when providing annual disclosure to The Exchange, and timelines for such disclosures.

Whilst developing the guidelines, The Exchange noted that Issuers may be at varying levels of understanding sustainability disclosure requirements and capacity to comply with the requirements. The Exchange encourages all Issuers to adopt the practice of sustainability reporting.

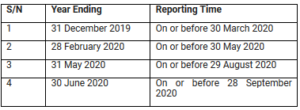

The Guidelines are available in electronic form at www.nse.com.ng and will be distributed to Issuers who are listed on all the Boards of the Exchange. The Guidelines will become effective on January 1, 2019. They will be mandatory for companies listed on the Premium Board of the Exchange and the following reporting compliance timeline shall apply.

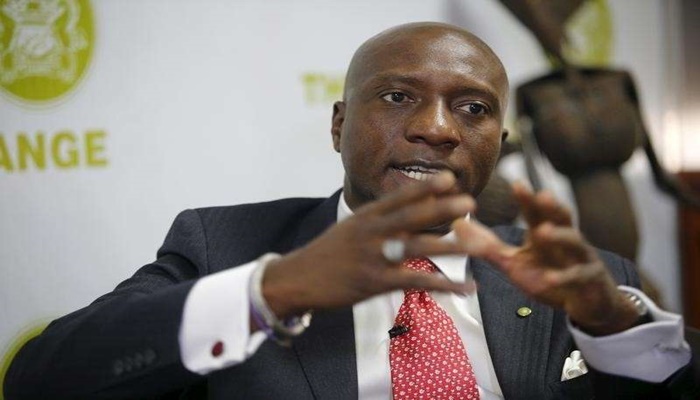

Whilst describing the objectives of the Sustainability Disclosure Guidelines, the Chief Executive Officer of NSE, Mr. Oscar N. Onyema, OON, explained: “We are supporting the global agenda of green and sustainable finance, which is so critical for Africa. As the first Exchange to list a sovereign green bond in Africa, our issuance of these Guidelines is to further enable investors ascertain their exposure to ESG risks whilst providing our Issuers a platform to disclose them along common themes for comparability. We encourage peer exchanges on the continent to continue to enhance information disclosure in their markets as this will help build trust”.

On his part, Mr. Olumide Orojimi, Head, Corporate Communications at The NSE was of the view that: “with continued global participation in our market, a shared framework of ESG principles with multi-stakeholder approach and metrics is imperative. The Guidelines set out recommendations for good practice in thirteen thematic areas under four core principles in ESG reporting. With the launch of these Guidelines, investors can look forward to a consistent approach to ESG reporting from Issuers listed on The NSE”.

As a member of the United Nations Sustainable Stock Exchanges (SSE) initiative, and the World Federation of Exchanges (WFE), NSE is committed to providing its listed companies with guidance on sustainability reporting, and has taken steps to demonstrate its commitment through a number of pre-implementation activities.

The first major step was the hosting of the inaugural Nigerian Capital Market Sustainability Conference (NCMSC) in November, 2015, which served as a stakeholder engagement session to discuss the business value of sustainable investment, enhancing corporate transparency and ultimately performance on Environmental, Social and Governance (ESG) issues.

The outcomes from the conference and results from relevant assessments were said to have aided in the production of the draft Sustainability Disclosure Guidelines (SDG). The NSE also held a Sustainability Reporting Seminar on June 8, 2016 to intimate stakeholders with the Guidelines, the reporting format and template, and the real value proposition of reporting.

The draft Guidelines were subsequently taken through The Exchange’s rule making process, exposed for stakeholders’ comments, and submitted to the Securities and Exchange Commission for approval.